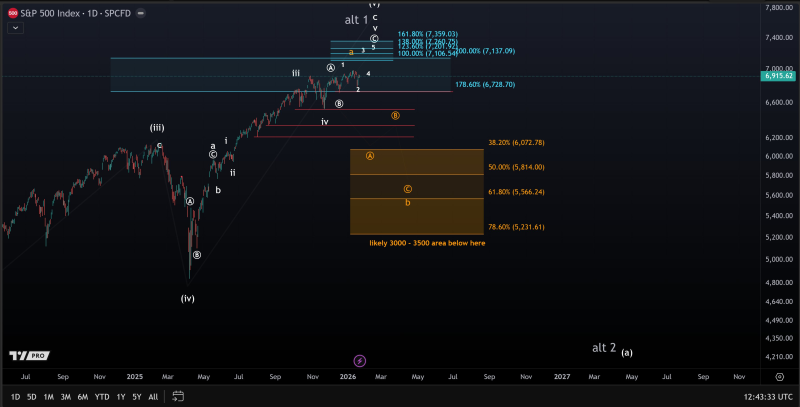

⬤ The S&P 500 is hovering near record territory, and that's got traders wondering if we're looking at a major turning point. Current price action suggests the market might be getting close to a significant top, which means the odds of a correction are rising—and it could be bigger than the shallow dips we've seen lately. The index has shifted into consolidation mode after a long climb, with the rally losing steam as it bumps up against key resistance zones.

⬤ The technical chart shows a mature uptrend that's been building since the last major bottom. Price has now reached a crowded resistance area where multiple extension levels are stacking up—a setup that often signals the rally is running out of gas. Meanwhile, several downside targets sit well below current levels, suggesting that if selling kicks in, the drop could be significantly larger than what we've experienced over the past year.

The market has become increasingly stretched after a prolonged advance, and momentum indicators suggest diminishing upside follow-through.

⬤ What we're seeing is a market that's pushed too far, too fast. Momentum is fading, and the wave structure hints that this move could be wrapping up. If the sellers take control, the pullback likely won't be quick or clean—it could unfold in multiple stages instead of one sharp drop.

⬤ This matters beyond just the S&P 500 itself. As the go-to benchmark for global risk appetite, any serious correction here would ripple across equity markets worldwide and shift sentiment in other asset classes. With price pressing against critical technical levels and warnings of a potential top gaining traction, what happens next could set the tone for the market's direction in the months ahead.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko