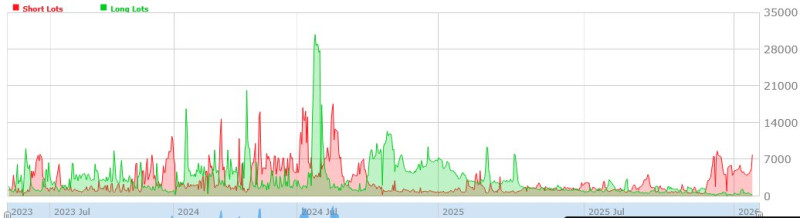

⬤ Retail traders continue to favor the short side of AUD/USD, with current data showing roughly 9,200 lots positioned short. The chart tracking retail exposure over time reveals a consistent pattern: traders prefer betting against the Aussie dollar. Short interest is currently sitting near the top of its usual range, while long positions remain relatively quiet.

⬤ There's a clear difference in how retail traders approach long versus short positions. Long positions typically stay within a comfortable range of about 4,000 to 6,000 lots. When they spike above 15,000 to 20,000 lots, it's usually driven by emotion rather than strategy. These surges are rare and often happen when traders get overly optimistic during sharp price movements.

⬤ Short positions tell a different story. They tend to cluster between 5,000 and 7,000 lots, with regular expansions toward the 10,000 to 14,000 range. This steady buildup suggests traders are adding bearish bets gradually rather than jumping in all at once. The data shows these short positions stick around longer, even when market conditions change.

⬤ What makes this interesting is that extreme positioning—not average levels—has historically coincided with increased volatility and potential reversals. When too many traders crowd onto one side, it often signals a sentiment imbalance. With AUD/USD retail shorts elevated and long participation subdued, the current setup suggests the crowd is heavily one-sided. As positioning stays skewed, shifts in liquidity and sentiment could significantly influence where the pair heads next.

Yuriy Ukazkin

Yuriy Ukazkin

Yuriy Ukazkin

Yuriy Ukazkin