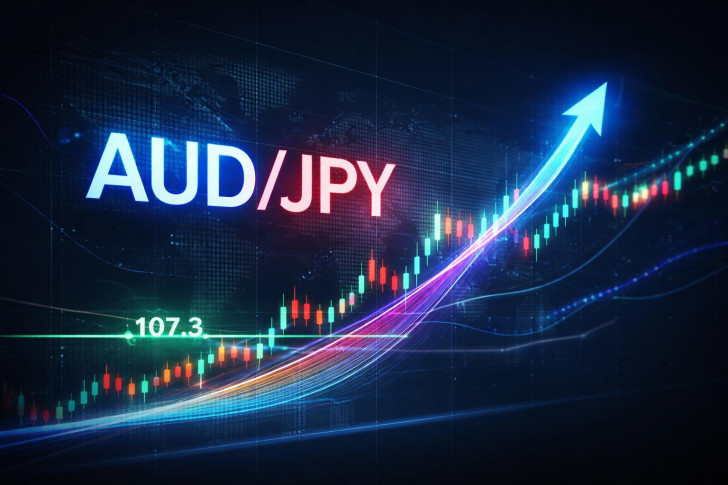

⬤ AUD/JPY has pulled back into a technically important support area after cooling off from recent highs. The pair is now sitting near the 107.3 level following its earlier push above 108.5, and Elliott Wave traders are watching closely. The setup suggests we could see at least a three-wave bounce from the blue box support zone between 106.56 and 107.39 in the coming week. As long as the pair stays above the critical 105.16 invalidation level, the broader structure remains intact.

⬤ The chart shows a clear impulsive rally followed by what looks like a corrective wave (4) pullback. Price has dipped into the blue box zone where buyers have stepped in before. From here, the expected path isn't a massive impulse higher, but rather a three-wave corrective rally—basically a bounce that unfolds in stages rather than one straight shot up.

⬤ What makes this setup interesting is that selling at these levels isn't recommended based on the wave structure. The pair is still respecting higher support levels and hasn't broken down through any major floors. If the bounce plays out as expected, we'd likely see an initial push up from the blue box, some consolidation, then another leg higher to complete the three-wave pattern.

⬤ AUD/JPY often acts as a risk sentiment gauge since it ties together Aussie growth expectations and Japanese yields. If this three-wave rally materializes from the 107.3 support zone, it would confirm that the recent dip was just a healthy pullback rather than the start of something uglier. The underlying bullish framework stays in play as long as support holds and the wave count doesn't fall apart.