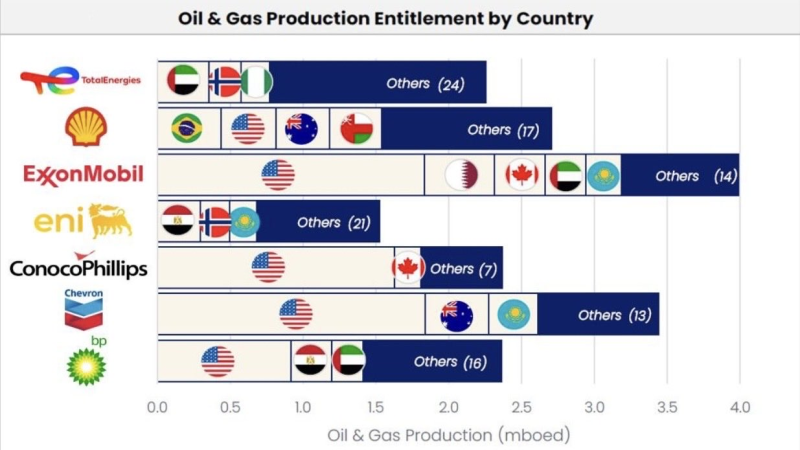

⬤ A small group of countries now controls the bulk of production for the world's biggest energy companies. The supermajors—ExxonMobil, Shell, Chevron, TotalEnergies, Eni, BP, and ConocoPhillips—have narrowed their geographic focus to regions where geology and politics align in their favor. Production entitlement data reveals this strategic shift toward fewer, bigger bets.

⬤ The United States leads as the top production source for multiple supermajors. Shale plays and Gulf of Mexico assets drive volumes for ExxonMobil, Chevron, and ConocoPhillips, with BP holding significant stakes too. U.S. output forms the production backbone across these companies, capitalizing on unconventional resources and operational flexibility. North America has become essential for maintaining and growing total supply.

⬤ The Middle East and Africa make up the second major hub, with Qatar, the UAE, Nigeria, and Angola hosting crucial LNG, deepwater, and gas projects for Shell, TotalEnergies, and Eni. These countries offer long-life assets with predictable production curves. Kazakhstan stands out through the Tengiz field, pumping over 600,000 barrels daily and serving as a cornerstone for Chevron, ExxonMobil, and Eni under stable long-term contracts.

⬤ Latin America drives the next wave of growth within this concentrated map. Brazil's pre-salt reserves anchor output for Shell and TotalEnergies, while Guyana has exploded into one of ExxonMobil's fastest-expanding sources. The pattern is clear: supermajor production increasingly flows from a select group of geologically rich, politically stable nations. Global supply dynamics now hinge on developments in these few critical zones.