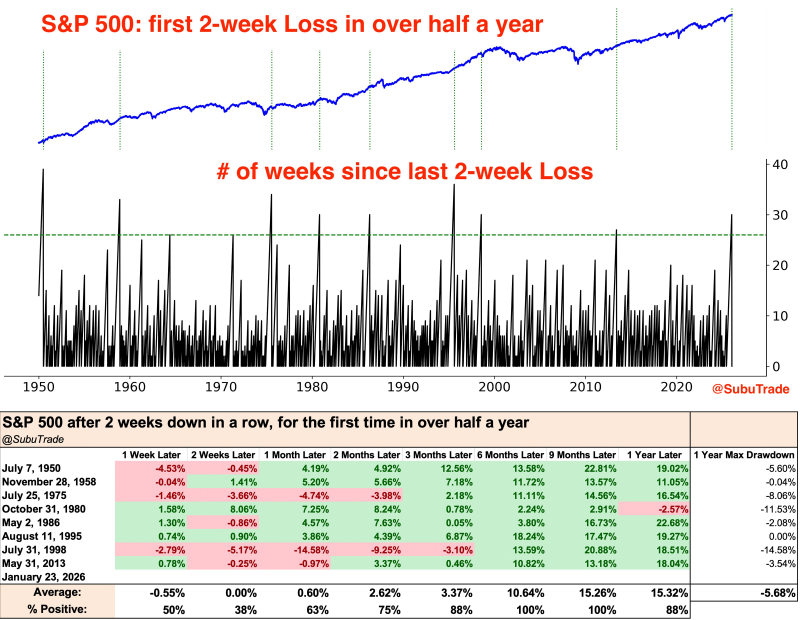

⬤ The S&P 500 has now dropped for two weeks straight—its first consecutive losing streak in over half a year. This kind of pullback hasn't happened often during the current bull run, which makes it stand out. While the recent slide breaks the market's steady upward march, it also raises an interesting question: what typically happens after these rare two-week dips?

⬤ Looking at decades of market data, every single time the S&P 500 posted a two-week decline like this, the index was trading higher six to nine months later. Every single time. The numbers back this up—six months after similar losing streaks, the S&P 500 gained an average of 10.6 percent. That's a pretty compelling track record that shows short-term pain often sets the stage for medium-term gains.

The historical tendency despite short-term weakness has been remarkably consistent toward positive outcomes.

⬤ What makes this pattern especially noteworthy is how rarely these two-week losing streaks actually occur during bull markets. The gaps between them tend to stretch for months, reinforcing how unusual they are when uptrends dominate. And while the immediate aftermath of these declines can be bumpy, the six- and nine-month windows have shown positive returns in literally every historical case on record.

⬤ So what does this mean for today's market? It puts the recent weakness into perspective. Yes, volatility might spike in the near term, but history suggests these pullbacks are typically just speed bumps in longer upward cycles. Based on decades of comparable behavior, temporary declines like this one have consistently given way to stronger performance down the road.