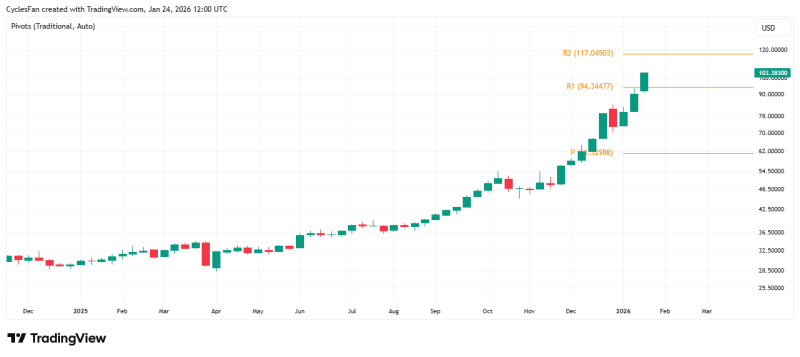

⬤ Silver just wrapped up an impressive week with a solid 14.7% gain, pushing the metal well into parabolic territory. The weekly close came in above the first yearly resistance level—a technically significant move that confirms buyers are fully in control. Since late 2025, price action has been all acceleration with barely any pullbacks, showing this isn't just a quick spike but a sustained uptrend.

⬤ Right now, silver's sitting around $103.38, comfortably above that first resistance zone near $94.34 and miles away from the yearly pivot at $62.30. The chart clearly shows the metal has already cleared an important annual threshold, and momentum remains strong. As one trader noted, "Silver's weekly close above the first yearly resistance confirms the strength of the current advance."

⬤ All eyes are now on the second yearly resistance level at roughly $117. Getting there would require another 13.2% climb over the next week if silver wants to hit that target by month's end. The chart shows a pretty clean pattern—higher prices with barely any consolidation as the metal pushes through one resistance zone after another.

⬤ What makes this move interesting beyond just silver itself is what it signals for the broader precious metals market. When silver breaks through major yearly resistance levels like this, it often kicks volatility higher across commodities and reinforces the momentum play in metals overall. With silver holding above its first resistance and closing in on the next key level, the current rally is proving to be more than just noise.

Helena Izotova

Helena Izotova

Helena Izotova

Helena Izotova