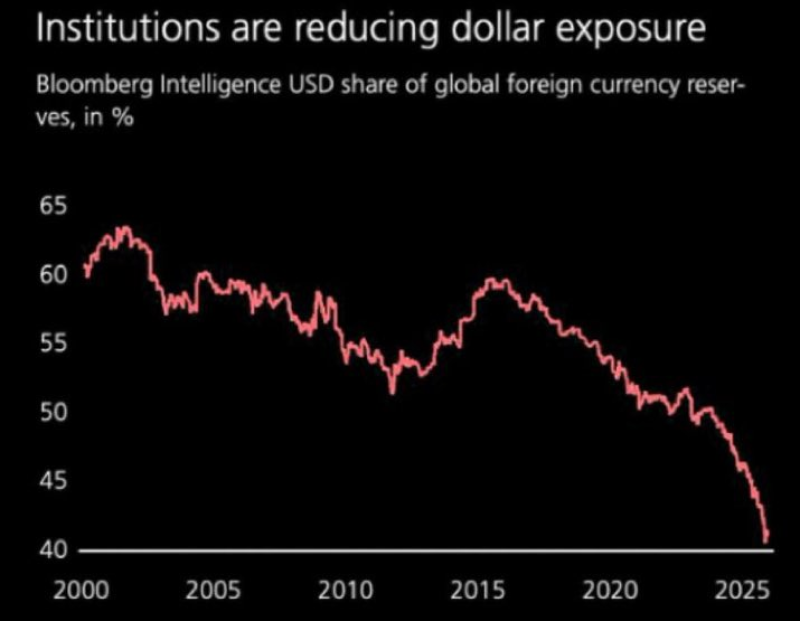

⬤ The US dollar's dominance in global reserves has been quietly eroding for over two decades. Bloomberg Intelligence data shows USD reserve share tumbling from above 60% in the early 2000s to approximately 40% by 2025—marking the lowest level in the documented period and signaling a fundamental shift in how institutions manage their currency portfolios.

⬤ The decline hasn't been sudden or dramatic, but it's been relentless. The dollar peaked above 65% of global reserves in the early 2000s before entering what appears to be a structural downtrend. There were brief recoveries—most notably in the mid-2010s—but each rebound was followed by renewed weakness. The pace has picked up since 2020, with the recent drop accelerating the long-term pattern.

⬤ This matters because the dollar still anchors international trade, provides global liquidity, and serves as the world's primary reserve currency. But institutions are clearly diversifying. The steady 20+ percentage point decline over two decades tells a story about changing confidence, shifting power dynamics, and evolving strategies in the international monetary system. As reserve managers continue reallocating away from dollars, the trend raises questions about the future landscape of global currency dominance.

Alex Bobrov

Alex Bobrov

Alex Bobrov

Alex Bobrov