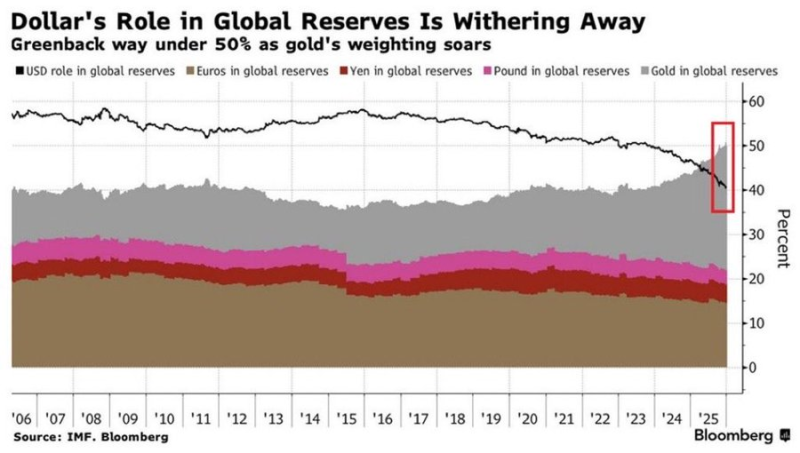

⬤ The dollar's dominance in global reserves is fading fast. Its share has plunged from about 60% in 2016 to roughly 40% today, according to IMF and Bloomberg data. Meanwhile, gold has been steadily claiming territory, rising from 35% to as much as 50% of global reserve allocations. The shift isn't sudden—it's been happening quietly, year after year, as central banks rethink what "safe" actually means.

⬤ Here's the interesting part: other major currencies haven't picked up the slack. The euro, yen, and pound have stayed relatively flat, meaning they're not absorbing the dollar's lost ground. Gold is. And that tells you something about where central banks see real security. The chart shows gold's line climbing while the greenback's slides—two lines moving in opposite directions, reflecting a fundamental change in reserve strategy.

⬤ What changed? The freezing and seizure of sovereign reserves in recent years shook confidence in assets tied to Western financial systems. Gold carries no counterparty risk—it doesn't depend on anyone's financial infrastructure or political goodwill. As one analyst noted, central banks now view gold as "a neutral store of value" that sits outside geopolitical crossfire. That perspective is driving allocation decisions in ways we haven't seen in decades.

⬤ This isn't a dollar collapse story. The greenback is still the world's largest reserve currency. But its dominance is eroding, and the shift toward gold signals something deeper—a structural adjustment in how the global reserve system operates. Central banks are diversifying away from concentrated exposure to any single country's financial system. Gold's steady rise reflects a long-term trend: when uncertainty rises, institutions move toward assets with zero counterparty exposure. That has real implications for currency demand, capital flows, and the architecture of international finance as we know it.

Serj Panchuk

Serj Panchuk

Serj Panchuk

Serj Panchuk