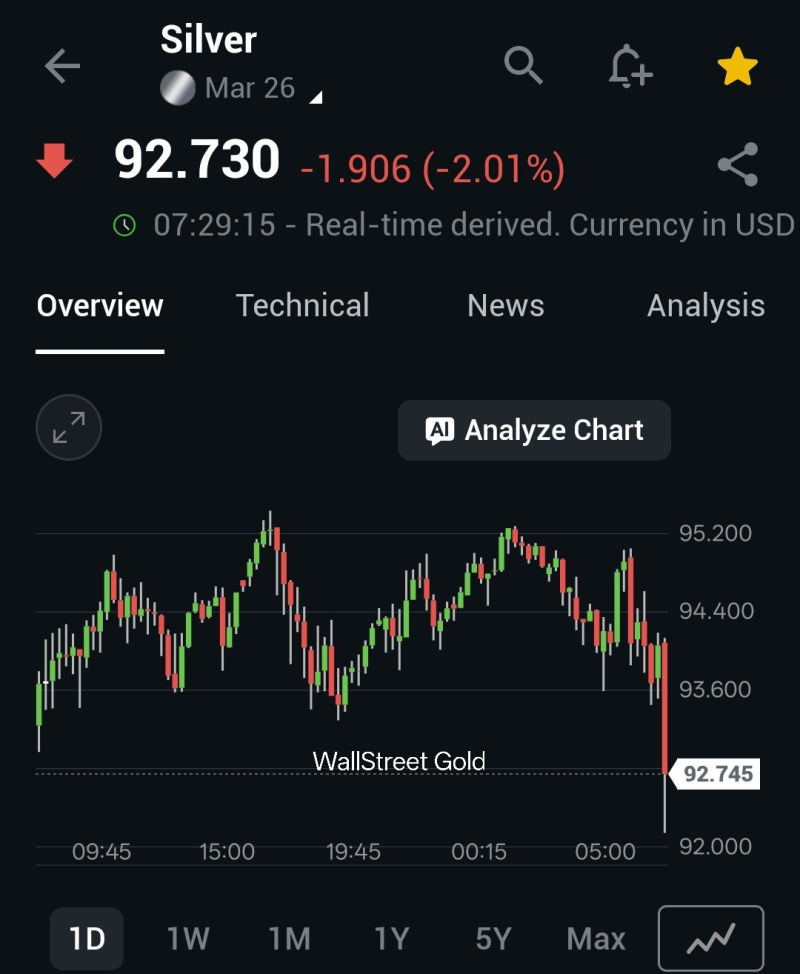

⬤ Silver futures took a beating during the latest session, crashing into the low $92s after buyers completely lost control. Prices hit $92.73—down roughly 2%—following a steep bearish candle that caught traders off guard. The drop happened fast, slamming into the lower boundary of the intraday range and flipping short-term momentum on its head.

⬤ Liquidity got hammered right at a critical support zone as silver futures went into freefall. Earlier in the session, prices had been bouncing around between the mid-$93s and low $95s, with traders making several attempts to hold the line. None of them stuck. Selling pressure exploded near the end of the move, blowing through the $93.00 level like it wasn't even there and driving silver straight into the low $92 zone.

⬤ Before the breakdown, silver had been trapped in a pretty tight range. Multiple quick rebounds toward the $94.00-$95.00 area just couldn't get any traction, leaving the market sitting duck once the downside momentum kicked in. The sharp drop lower shows that resting liquidity near support got wiped out in a hurry—this wasn't some slow grind down. There weren't any real pauses during the selloff either, which tells you everything about how fast sentiment flipped once those key levels cracked.

⬤ This move matters because silver futures are known for going haywire when major support levels get tested. Landing in the low $92s puts price right at a technically loaded zone that can swing short-term sentiment hard. How silver handles this area is going to shape what traders expect next—whether we see some stabilization or if the pressure keeps building. Either way, it's going to ripple through the precious metals space in the sessions ahead.