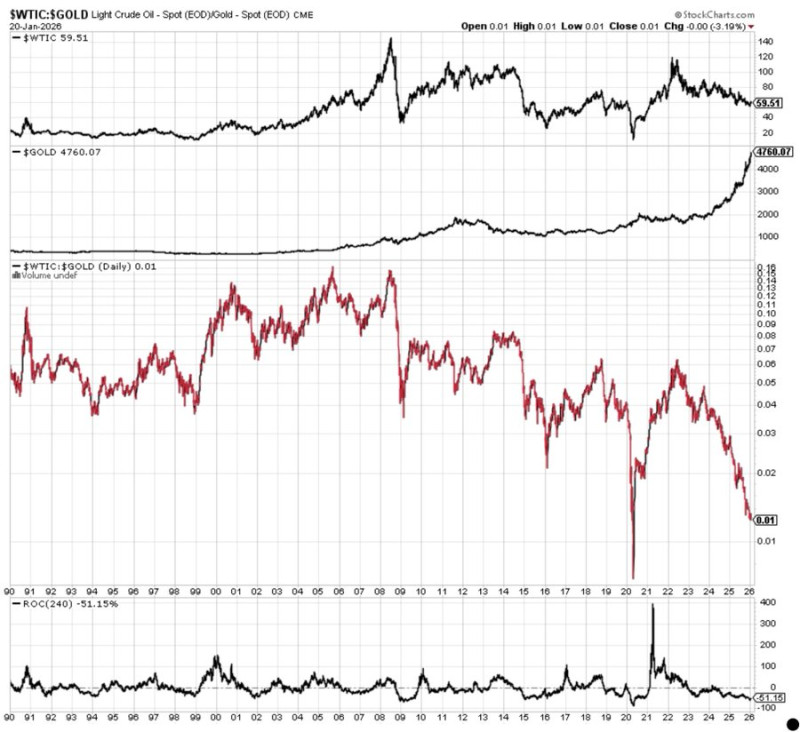

⬤ The energy landscape is going through a major transformation that's been quietly unfolding for years. Crude oil hit nearly $140 back in 2008, and while it's bounced around since then, it's now trading under $60. But here's what really tells the story: when you measure oil against gold instead of dollars, it's been losing value consistently for decades. That's not just a temporary dip—it's a whole new reality for energy markets.

⬤ Gold has climbed steadily higher over the long haul, but oil hasn't been able to keep up with its old highs from previous decades. This gap shows something important: we're not in the same energy world we used to be. Oil prices might look stable in dollar terms, but when you stack them up against hard assets like gold, they're actually deflating. That's a completely different environment than what energy companies dealt with in the past.

⬤ This changes everything for how oil producers need to think about their business. The old playbook relied on rising real oil prices to justify exploration and expansion. Now? Companies that are winning focus on keeping costs lean, generating strong free cash flow, and staying financially flexible. As one analyst put it: "Companies that emphasize low maintenance capital expenditure and balance-sheet flexibility are better suited to operate as real oil prices continue to trend lower." Sometimes staying small and efficient beats trying to grow at all costs.

⬤ For investors, this matters because energy stocks aren't quite the inflation hedge they used to be. The game has shifted from betting on higher commodity prices to evaluating which management teams know how to thrive when real oil prices keep sliding. As the oil-to-gold ratio keeps evolving, success in the energy sector increasingly comes down to smart capital allocation and operational discipline rather than just riding the next price wave.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur