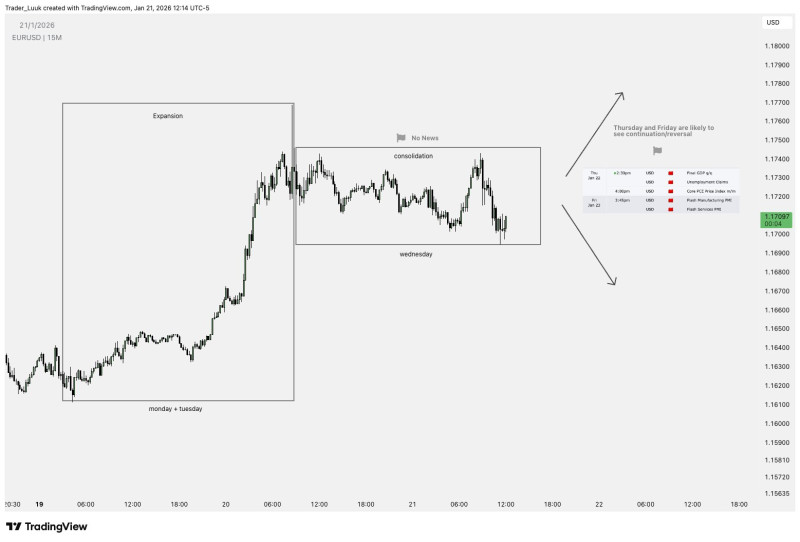

⬤ EUR/USD hit the brakes after a solid two-day rally earlier this week. Following strong moves in one direction, the market typically takes a breather for a day or two before deciding its next step—either pushing higher or pulling back. The 15-minute chart captures this pattern perfectly: Monday and Tuesday brought clear upward momentum, while Wednesday saw the pair trading sideways in a tight range.

⬤ The currency pair climbed from the lower 1.16 zone all the way to 1.17 during the first part of the week—a textbook expansion phase. But once it hit that level, the action cooled off considerably. Price started bouncing within narrow boundaries, showing the market was digesting the earlier move rather than charging ahead. This kind of pause is pretty standard after a strong directional run.

⬤ What made Wednesday's consolidation even more predictable was the absence of major economic news. When there's nothing significant on the calendar, markets tend to lose steam and drift sideways. Without fresh catalysts to drive decisions, traders often sit on their hands. That's why the focus now shifts to the next few sessions—when volatility is likely to return and the pair will either resume climbing or reverse course.

⬤ This consolidation matters because it sets the stage for what comes next. These pause periods act like reset buttons, absorbing the previous momentum while the market gathers itself for the next big move. With EUR/USD already having made its expansion and now sitting in limbo, the upcoming sessions could be crucial. Traders will be watching closely to see whether the pair breaks higher or changes direction as new data and trading activity kick back in.

Alex Bobrov

Alex Bobrov

Alex Bobrov

Alex Bobrov