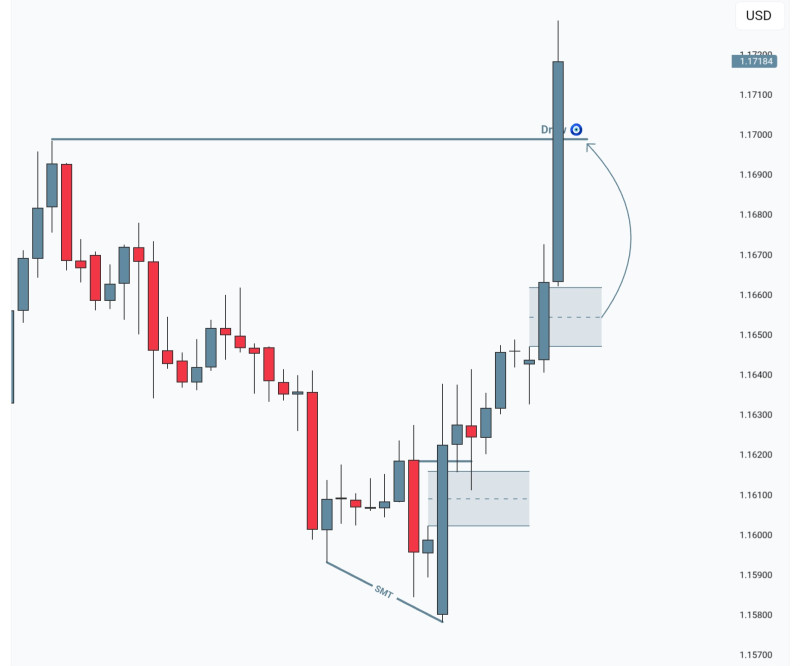

⬤ EUR/USD just wrapped up a textbook intraday rally, climbing from a liquidity sweep in the lower zones straight into its upside target. The pair rebounded hard from the 1.158–1.160 area and pushed higher toward 1.170–1.172, where the objective got tagged and completed.

⬤ The chart shows a clean liquidity grab near 1.158, immediately followed by a sharp bullish response. A strong impulse candle reclaimed internal structure and flipped short-term momentum upward. Price then paused around 1.165–1.166 in a shaded reaction zone, holding above former resistance and setting up the next leg higher.

⬤ After that brief consolidation, EUR/USD extended into the upper liquidity draw zone. A large bullish candle drove price into the 1.170 handle, confirming the intraday path was complete. The structure stayed clean throughout—higher lows held, and there was no aggressive rejection or breakdown at the target.

⬤ This matters for FX traders because completed intraday targets often trigger a reset in positioning. When price reaches a liquidity zone like this, it can lead to consolidation, a rotation, or a pause as the market digests the move. How EUR/USD behaves from here will likely shape near-term volatility and determine whether the pair holds steady or shifts into a new trading range.