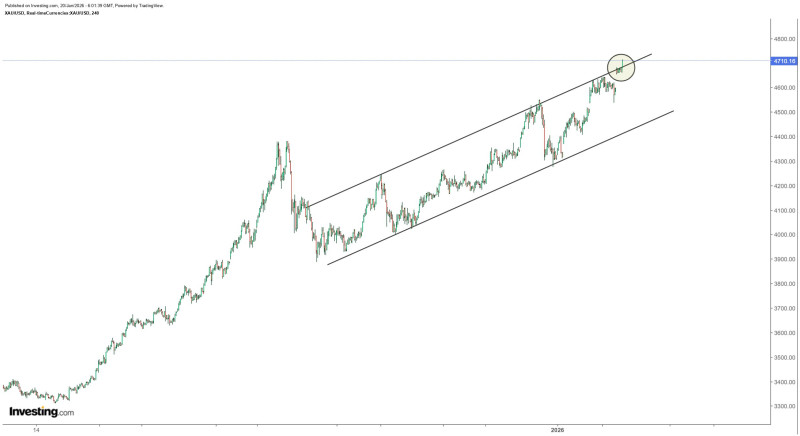

⬤ Gold kicked off the week with serious momentum, pushing into the upper $2,700s after finally breaking free from a three-month rising channel it had been locked in. The move wasn't subtle either—it came with a breakaway gap, the kind of technical signal traders watch for when they're trying to spot the next leg up. After weeks of grinding along inside that channel, XAU suddenly punched through the top and hasn't looked back.

⬤ Looking at the chart, gold spent most of late 2025 riding that upward slope, steadily posting higher lows and higher highs without much drama. Then in January, something shifted. Instead of bouncing off the upper boundary like it had been doing, price exploded through it from near the top of the range. That's the kind of breakout that usually doesn't happen slowly—it's fast, it's sharp, and it tells you buyers are stepping in hard. Now that XAU is holding above what used to be resistance, the short-term picture has clearly flipped bullish.

⬤ What's making this move even more interesting is that gold miners are finally showing up to the party. Historically, when mining stocks start moving in sync with spot gold, it tends to confirm that the rally has legs. At the same time, traders are starting to talk about a potential split in the precious metals space—gold could keep running while silver lags behind. That divergence, if it plays out, would be worth watching closely in the weeks ahead.

⬤ For the broader market, gold's breakout matters beyond just the metal itself. XAU often acts as a barometer for risk appetite and macro positioning, so when it clears a major technical level like this, it can ripple across commodities and related sectors. If this momentum holds, gold's acceleration could keep driving the narrative in precious metals and pull more capital into the space.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko