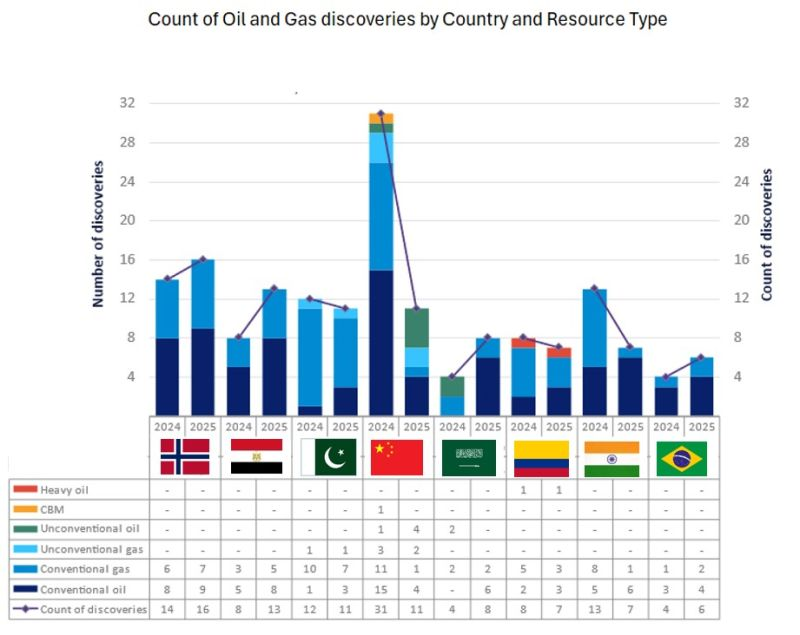

⬤ Global oil and gas exploration is becoming more strategic and infrastructure-focused, with recent discoveries favoring mature basins over high-risk frontier regions. Data covering 2024 and 2025 highlights a clear change in upstream behavior, where proximity to existing facilities and faster development timelines are taking priority over large, capital-intensive exploration bets.

⬤ Norway tops the rankings again in 2025, recording 16 oil and gas discoveries—9 oil and 7 gas finds. Most discoveries sit near established North Sea infrastructure, allowing operators to connect new resources into existing pipelines and processing systems. This approach cuts development costs and accelerates production timelines. Norway continues extracting value from incremental discoveries in a mature basin environment.

Oil and gas exploration is becoming smaller in scale, faster to execute, and increasingly infrastructure-led.

⬤ Egypt follows with 13 discoveries in 2025: 8 oil and 5 gas finds. These are largely concentrated onshore, particularly in the Western Desert. Egypt's exploration strategy focuses on strengthening domestic supply and reducing import dependence by leveraging existing infrastructure. Onshore development enables faster project execution compared with offshore frontier plays.

⬤ Across all countries shown, the pattern is consistent. Exploration is becoming smaller in scale, faster to execute, and increasingly infrastructure-led. Large frontier discoveries are now rare, while brownfield tie-backs and near-field developments are gaining prominence. This shift signals a structural change in how new supply comes online—prioritizing reliability, cost control, and energy security over volume-driven expansion.