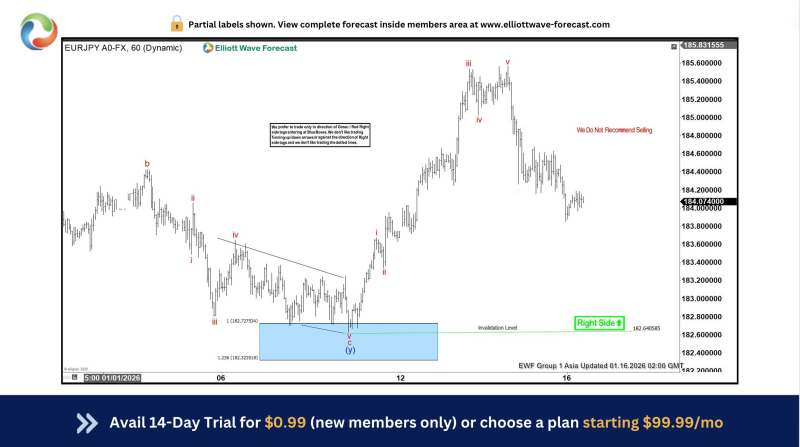

⬤ EUR/JPY is trading at fresh highs after pulling away from a well-defined support area. The pair completed its pullback phase and resumed climbing, showing that buyers are back in the driver's seat. Price has moved decisively higher from the consolidation zone, confirming the uptrend is still intact.

⬤ The chart shows strong buying pressure kicked in from the blue demand zone near 182.64, where support held firm. From there, EURJPY built a series of higher lows and higher highs—classic signs that momentum has shifted back to the bulls. The earlier sideways chop has given way to directional movement, suggesting sellers have been cleared out.

⬤ Elliott Wave analysis indicates the pair is moving through an impulsive phase rather than rolling over into a deeper correction. Price is holding above major structural support with no signs of invalidation yet. While short-term dips are normal, the overall setup still favors upside as long as those support levels stay protected.

⬤ This breakout stands out because EURJPY is showing clear direction while many other currency pairs are stuck in ranges. The fact that it's making new highs without breaking down structurally tells you there's real conviction behind the move. As long as key support around 182.64 holds, traders are likely watching for more upside with momentum driving the action.

Alex Bobrov

Alex Bobrov

Alex Bobrov

Alex Bobrov