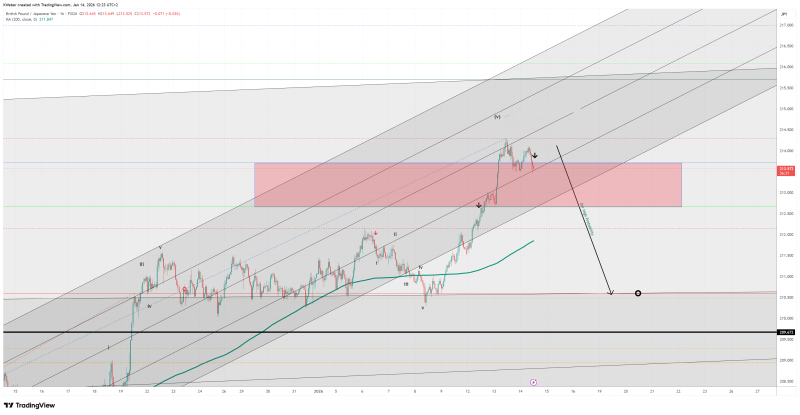

⬤ GBP/JPY took a nosedive during the Asian session, pulling back hard from its recent highs on the hourly timeframe. A short position that was actively managed throughout the move got closed right around the 210.6 mark, with traders adding to their positions as the pair kept sliding. The charts tell the story of a textbook reversal that played out exactly as anticipated after the earlier climb ran out of steam.

⬤ The first chart shows the pair topping out after failing to stick at higher levels inside an upward channel. Once that support gave way, GBP/JPY didn't mess around—it rolled over and accelerated downward through consecutive hourly candles. The decline brought prices straight into the target zone around 210.6, which is exactly where the short got closed out and profits locked in.

⬤ Chart number two picks up where the action continued, with GBP/JPY briefly touching that 210.6 level before catching its breath. "The drop unfolded rapidly, reflecting strong short-term selling pressure," showing just how fast momentum can flip in currency markets. After hitting the target, you can see a modest bounce forming as the pair stabilized following that aggressive downside leg.

⬤ This kind of move matters for the broader forex market because GBP/JPY is often a bellwether for short-term momentum swings and risk appetite shifts. When you see an intraday reversal this sharp after an extended run, it's a reminder that conditions can flip on a dime. How price behaves around this 210.6 zone could set the tone for volatility and positioning strategies in the trading sessions coming up.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur