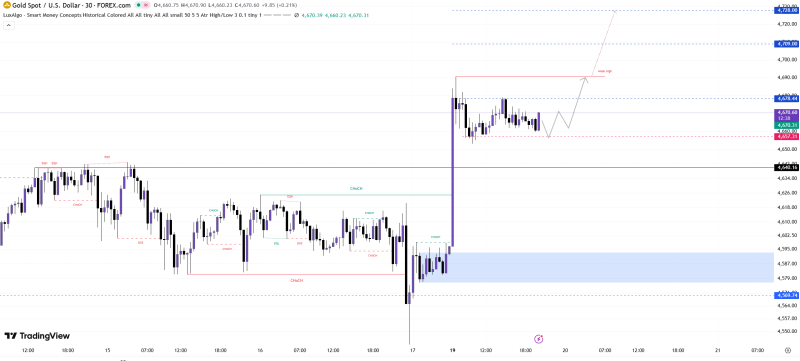

⬤ Gold is holding strong in bullish territory, trading above the crucial 4657 and 4640 support levels. The price action shows clear stabilization above a well-defined demand zone after a sharp push higher, keeping the uptrend alive and well.

⬤ The technical picture looks solid right now. We're seeing higher lows form consistently, with buying interest staying active around the support area. After bouncing from the lower zone, gold climbed toward 4670 and started consolidating there. This isn't weakness—it's just the market digesting the recent move. The next immediate target sits between 4678 and 4684, where near-term resistance is waiting.

The uptrend remains valid as long as XAU/USD holds above the 4657 and 4640 support levels.

⬤ If gold breaks cleanly above the 4678-4685 resistance band, things could get interesting fast. The chart opens up room for a run toward 4709-4728, where the next major resistance cluster lives. On the flip side, support is clearly marked at 4640, then 4631 and 4613 below that. As long as price stays above these levels, the bullish structure stays intact.

⬤ This matters because gold often signals broader market sentiment shifts. Trading above key support like this shows real underlying strength. A confirmed breakout higher could fuel more bullish momentum, while the current consolidation is basically the market deciding whether to launch another leg up or settle into range-bound trading for a while.