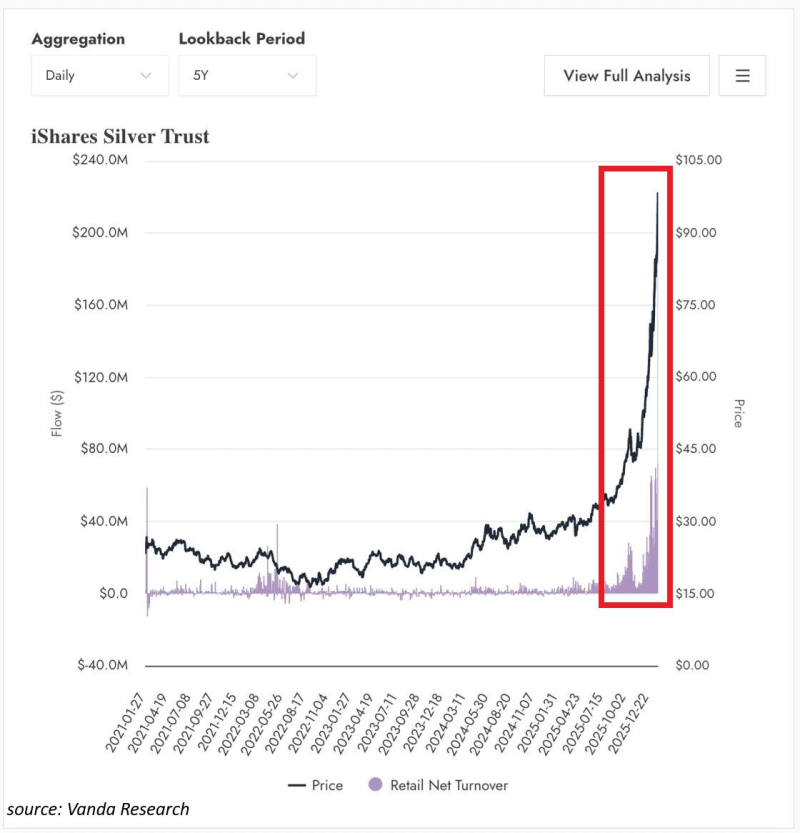

⬤ Retail interest in silver has exploded, with individual investors buying a record $171 million of the iShares Silver Trust in one session—the largest daily retail inflow ever recorded for the silver-backed ETF. The surge marks a dramatic acceleration in both price and retail participation, clearly separating recent activity from anything seen over the previous five years.

⬤ The $171 million inflow into SLV nearly doubled the $93 million recorded during the peak of the 2021 silver squeeze, according to Vanda Research data. Retail turnover in SLV is running at approximately 11.6 times normal levels—an unusually concentrated focus on silver-linked assets. For context, retail turnover in NVIDIA shares is roughly 7.5 times normal levels, showing just how extreme silver participation has become.

⬤ Retail positioning isn't one-sided. The 2x Short Silver ETF ZSL is recording the highest inflows on record, meaning retail traders are aggressively expressing opposing views through leveraged products. Record inflows into both long and short silver vehicles point to heightened conviction and disagreement within the retail crowd.

⬤ This matters because extreme inflows and elevated turnover often coincide with increased volatility and rapid price swings. Silver has become a focal point for speculative positioning, and with retail participation at historically elevated levels, price behavior is likely to remain sensitive to shifts in sentiment and positioning across both bullish and bearish exposures.

Serj Panchuk

Serj Panchuk

Serj Panchuk

Serj Panchuk