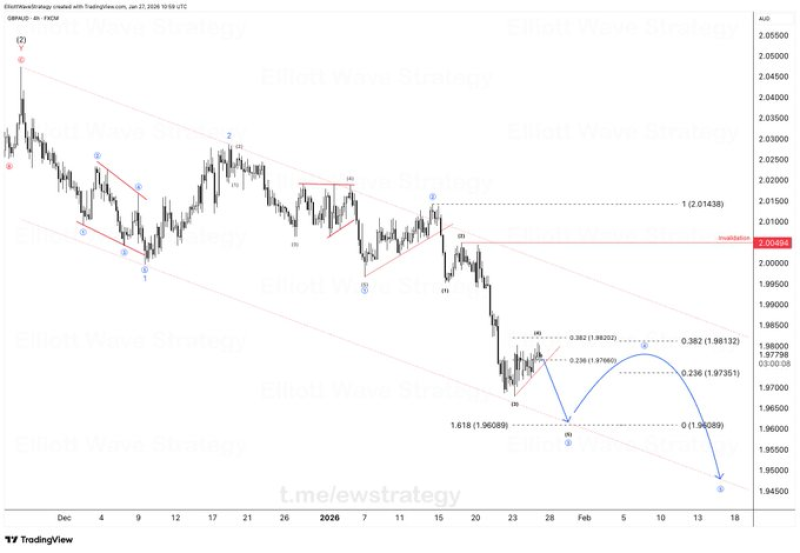

⬤ GBP/AUD remains stuck in a downtrend, with recent price action showing only a brief pause. The pair experienced a modest bounce after a sharp drop, but the chart reveals this is happening inside a well-defined bearish channel.

⬤ The Elliott Wave framework identifies this recent recovery as Wave 4—a typical correction after an impulsive decline. These corrective phases often create confusion, as traders mistake them for trend reversals. The overlapping price action and weak upside momentum during this bounce fit classic Wave 4 behavior within a larger bearish sequence.

Brief upward movements are often mistaken for market bottoms during strong trends.

⬤ The chart's blue projection path shows a corrective pullback before the downtrend potentially resumes. Wave labeling and price projections point to renewed downside pressure once this correction wraps up.

⬤ This setup underscores why separating corrections from reversals matters in trending markets. Short-term bounces can ease selling pressure temporarily without changing the bigger picture. As long as price stays within the bearish channel, expect more corrective pauses followed by moves lower.