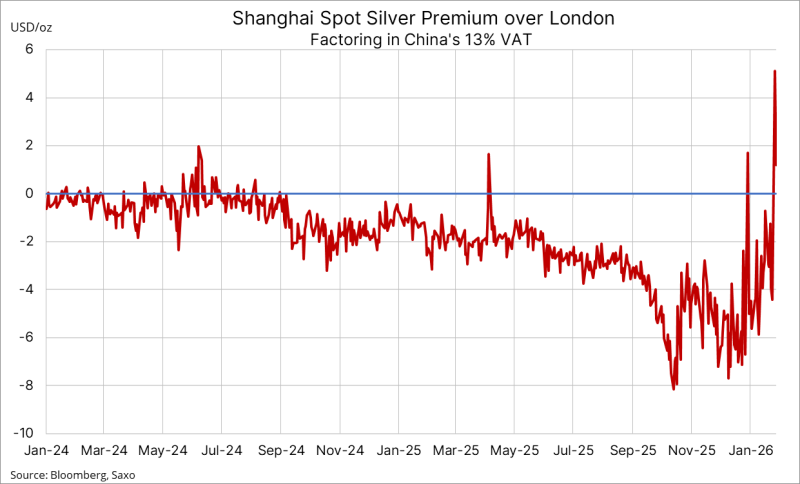

⬤ Premium Surge Was Brief and Tax-Driven The gap between Shanghai and London silver prices jumped dramatically but didn't last long once China's 13% value added tax was factored in. When you strip out that VAT—which gets applied to physical silver delivery—the Shanghai premium shot up to just over 5% before dropping back down to roughly 1%. The chart tracking this movement shows the real story isn't about sustained repricing between markets, it's about short-term swings.

⬤ Shanghai Traded at a Discount for Most of 2024 Throughout most of 2024 and into early 2025, Shanghai silver actually traded below London prices when the VAT was properly accounted for. The adjusted premium stayed mostly negative, meaning Shanghai was cheaper. Then volatility kicked in hard—the premium swung from deeply negative to a sudden spike, followed by an equally quick retreat. These wild fluctuations highlight temporary market noise rather than any fundamental shift in how the two markets price silver.

Accurately gauging the true premium requires stripping out China's 13 percent VAT, which applies to physical silver delivery.

⬤ The 13% VAT Isn't New—But Higher Prices Amplify It China's 13% VAT on physical silver has been around since 2019, so it's not exactly breaking news. What matters now is that as XAG silver prices have climbed to significantly higher levels, that 13% tax takes a bigger bite in absolute terms. Without adjusting for it, the headline Shanghai-over-London spread looks much wider than what's actually happening in the physical market. The tax is proportional to price, so when silver rallies, the nominal spread inflates mechanically—not because demand patterns changed, but because the math changed.

⬤ Why This Matters for Silver Markets Getting the VAT adjustment right is essential for reading current silver market conditions accurately. When you properly account for the tax, you can separate price differences driven by tax mechanics from those driven by real shifts in physical supply or demand. With silver prices still elevated and volatile, understanding what's really moving cross-market spreads helps traders and analysts avoid misreading sentiment and pricing signals in the global silver market.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko