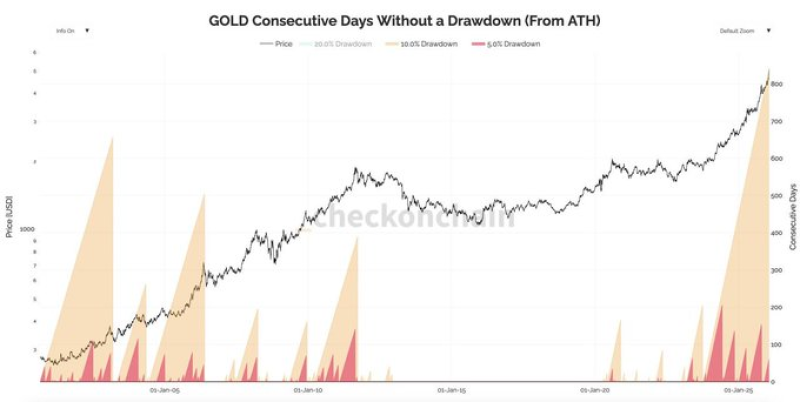

⬤ Gold enters rare stability zone lasting 840 days — XAU has pulled off something pretty unusual: nearly 840 straight days without dropping 10% from its all-time highs. This kind of unbroken streak rarely happens in gold markets, where deeper pullbacks normally show up during long rallies. Price charts tracking drawdown levels make it clear—there's been no 10% correction throughout this entire stretch.

⬤ Historical comparison reveals stark difference — Looking at the long-term price chart with zones marking 5%, 10%, and 20% drawdowns, earlier cycles tell a different story. Past gold advances came with frequent volatility clusters and corrective dips. The current phase? Prices kept climbing to fresh highs without triggering that 10% threshold. It's a striking departure from how gold typically behaves.

⬤ What makes this streak stand out — Previous decades show that sustained gold rallies usually got interrupted by sharper corrections before the next leg up. The 840-day period we're seeing now breaks that pattern with noticeably calmer volatility and steady acceptance of higher price levels. Markets just keep absorbing new highs without the usual pullback pressure.

⬤ Why this matters beyond gold markets — Since gold acts as a benchmark for stability and risk sentiment, this prolonged stretch without major corrections shapes expectations across multiple asset classes. Traders and investors watch gold closely, and when it avoids significant drops for this long, it influences how people think about volatility and price behavior elsewhere. The big question now: what happens when momentum finally shifts, given how rare this kind of extended run has been historically.

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia