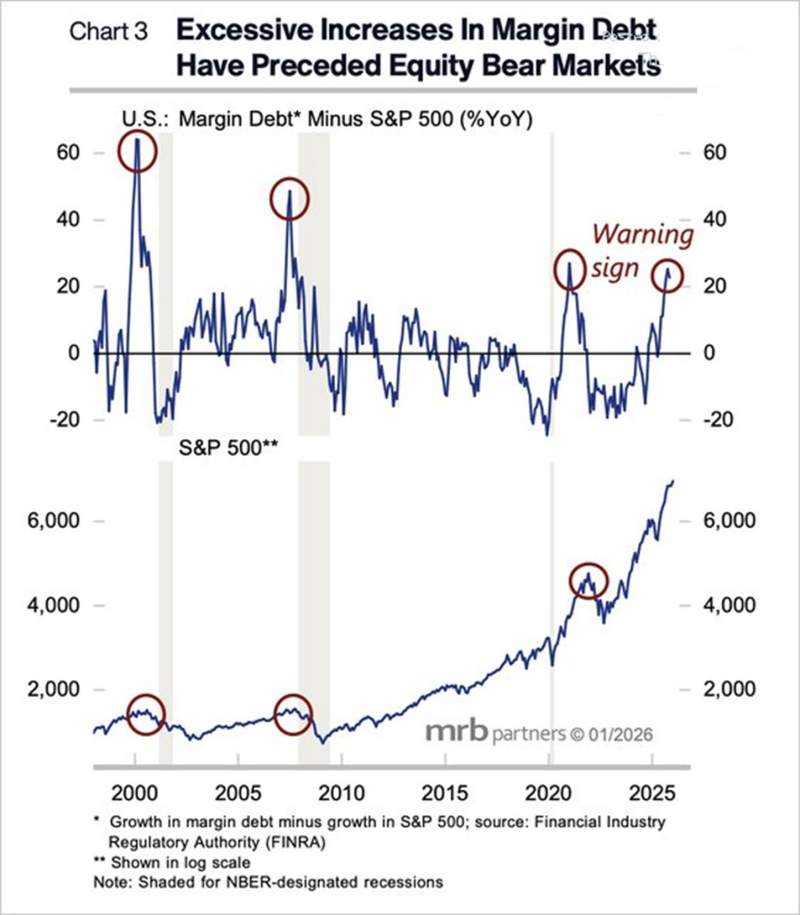

⬤ US margin debt just broke records again, hitting levels that should make investors pause. The latest numbers show borrowing has been climbing for eight straight months now, with traders piling on leverage faster than the market's actually rising. When you compare how quickly margin debt is growing versus S&P 500 gains, you'll see the biggest gap since 2021.

⬤ The numbers tell a clear story: margin debt jumped by roughly $326 billion in just one year, pushing the total to around $1.2 trillion. What's concerning isn't just the size, it's the speed. Leverage is expanding way faster than stock prices are climbing. This gap between borrowing and market performance has historically been a red flag that shows up right before things get rocky.

⬤ We've seen this movie before. The same pattern appeared just before the 2000 dot-com crash and again ahead of the 2008 financial crisis. In both cases, traders borrowed heavily during strong rallies, then got caught when markets turned. Right now, the spread between margin debt growth and index performance sits at levels that match those warning zones.

⬤ Why does this matter? When leverage gets this high, markets become fragile. Even small price drops can force traders to sell positions just to meet margin calls, which creates a cascade effect. With $1.2 trillion in borrowed money now riding on stocks and the gap versus actual market gains widening, the setup looks increasingly unstable.

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia