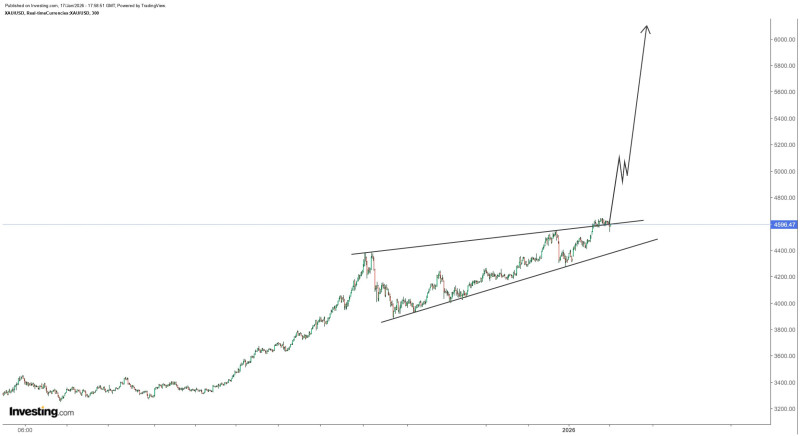

⬤ Gold (XAU) is trading near the top of a well-defined ascending wedge after climbing steadily from the low-4,000s to around $4,600 over the past three months. The price is now consolidating just beneath rising resistance, creating a compressed pattern that typically signals an upcoming directional move. This setup suggests gold is approaching a critical decision point as the trading range narrows and momentum builds.

⬤ The chart shows a clear series of higher lows supported by an upward-sloping trendline, while the upper boundary has been capping recent gains. This tightening range reflects consistent buying pressure rather than weakness, with bulls defending every dip. The first upside target sits around $5,100, which could be reached within approximately two weeks if price breaks above the wedge ceiling with strong follow-through.

⬤ After potentially reaching the $5,100 level, a brief consolidation period is expected. These pauses typically follow sharp rallies and allow momentum to reset without breaking the larger trend. If gold holds above previous resistance during this pause, the path could open toward $6,000 within the next three months, assuming the ascending pattern stays intact and pullbacks remain shallow.

⬤ This technical development carries broader market significance since gold often signals shifts in macro sentiment and long-term risk appetite. Continued strength from current levels would reinforce gold's position as a leading asset heading into 2026, especially if price keeps respecting the rising support line. The next move from this compression zone may influence sentiment across commodities and currency markets as traders evaluate whether the three-month uptrend is ready for its next expansion phase.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko