⬤ Gold (XAUUSD) is maintaining its bullish structure on the daily chart, holding comfortably above levels that used to act as resistance but now provide support. The recent pause in price action looks more like healthy consolidation than any sign of a trend reversal, with the metal respecting higher price levels after a strong rally.

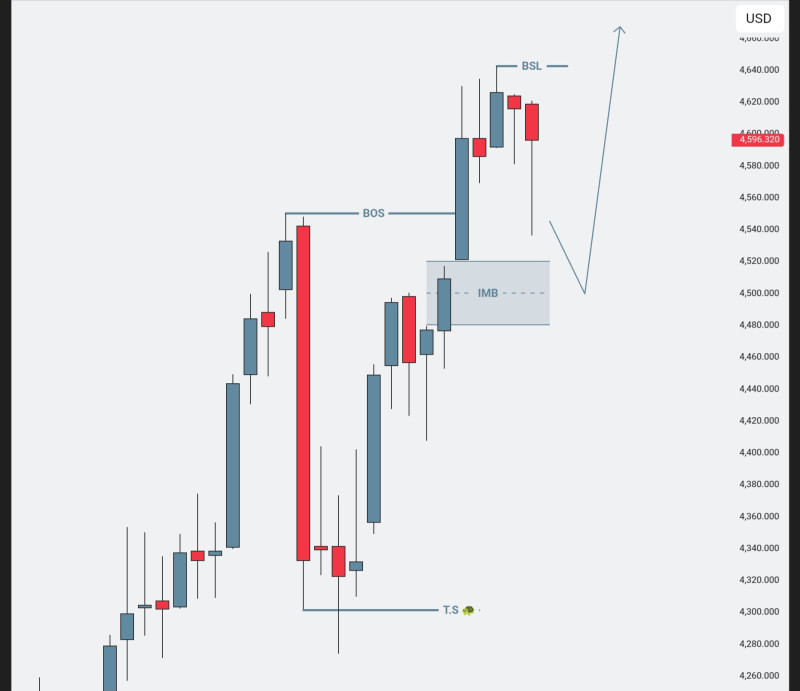

⬤ The chart shows a clear structural shift that kicked off the move, followed by a powerful surge from the low $4,300s up toward $4,600. After that impulse, gold pulled back into a marked imbalance zone where buyers stepped in to stabilize the price. The pullback was relatively shallow compared to the previous advance, which reinforces the idea that demand remains strong at these elevated levels.

⬤ Recent candles near the upper range show smaller bodies and mixed closes, pointing to short-term consolidation after the climb. The area above recent highs is marked as buy-side liquidity—a zone where sellers previously showed up but couldn't push price lower. Current price action around $4,596 reflects a natural pause after expansion rather than heavy selling pressure, with the daily structure still holding firm.

⬤ This setup matters because it shows gold maintaining strength after a significant repricing higher. As long as the metal stays above these former resistance zones, the trend remains constructive and any downside moves appear corrective rather than the start of something bigger. The structure continues to favor upward continuation over a directional shift.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko