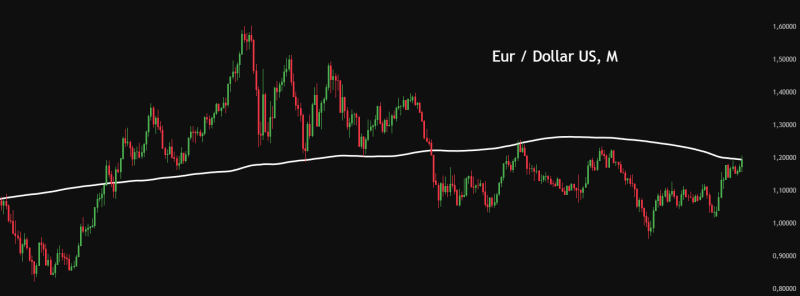

⬤ The euro has bounced against the US dollar, pushing EUR/USD back to its monthly 200-period moving average. This recovery brings the pair to a historically significant level that frequently serves as a dividing line between euro and dollar strength. The monthly chart shows price approaching this moving average after an extended period of dollar dominance.

⬤ Throughout major market cycles, EUR/USD has consistently tested the monthly 200-moving average, treating it as a boundary between sustained trends and temporary rebounds. Right now, the pair is testing this moving average but hasn't broken above it convincingly, leaving the longer-term picture uncertain.

⬤ A stronger dollar creates headwinds for companies earning abroad and for cross-border investments. When euro rallies stall near major technical levels like this, they typically reinforce the existing dollar-favored structure. Unless EUR/USD can hold above the monthly 200-moving average, the dollar maintains its structural edge.

⬤ This level matters because EUR/USD sits at the heart of global currency markets. The monthly 200-moving average has historically marked turning points that shape capital flows, trade dynamics, and regional performance. How the pair behaves here will determine whether this rebound becomes a meaningful shift or just another temporary correction in a dollar-led market.