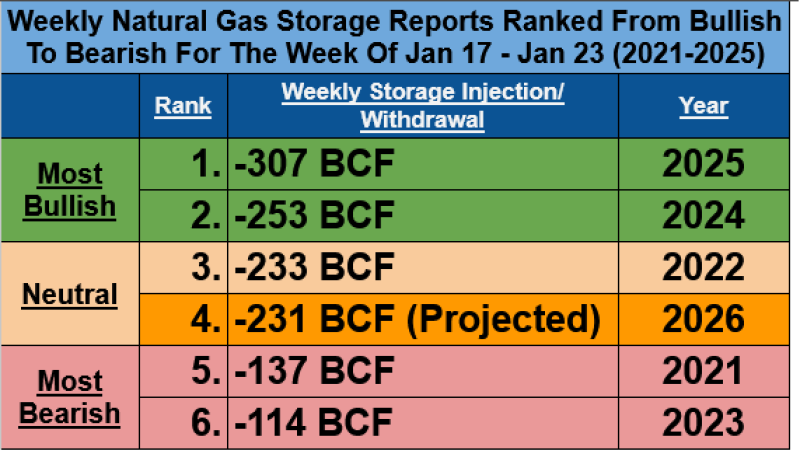

⬤ The natural gas market is focused on the upcoming EIA storage report for the week of January 17-23, which shows an expected withdrawal of 231 billion cubic feet. When you compare this to the same week over the past five years, it ranks fourth out of six—landing squarely in neutral territory rather than signaling any extreme market conditions.

⬤ Looking at historical data, this 231 BCF draw is about 24 BCF above the five-year average for this period, but it's still 76 BCF smaller than what we saw last year. Only two years—2021 and 2023—posted smaller withdrawals during this specific week, while 2025 and 2024 saw much bigger draws at 307 BCF and 253 BCF. That makes this year's projection the third-smallest withdrawal for this week in recent memory.

This positioning makes the current projection the third smallest withdrawal for the week over the past five years.

⬤ Weather patterns have been the main driver behind these storage swings. Years with harsh cold snaps produced deeper withdrawals, while milder winters kept draws modest. The timing of this report is interesting—it ends right before a major arctic blast hit, which explains why the numbers don't reflect extreme demand. We're seeing a relatively calm period in winter storage dynamics rather than peak seasonal stress.

⬤ Storage trends matter because they shape expectations around supply and price volatility in the natural gas market. A smaller withdrawal compared to last year suggests the fundamentals aren't tightening as quickly, even as traders turn their attention to upcoming reports that will capture the arctic outbreak's impact. The next few weeks of storage data will be critical for understanding where the market's headed.

Edward Culchenko

Edward Culchenko

Edward Culchenko

Edward Culchenko