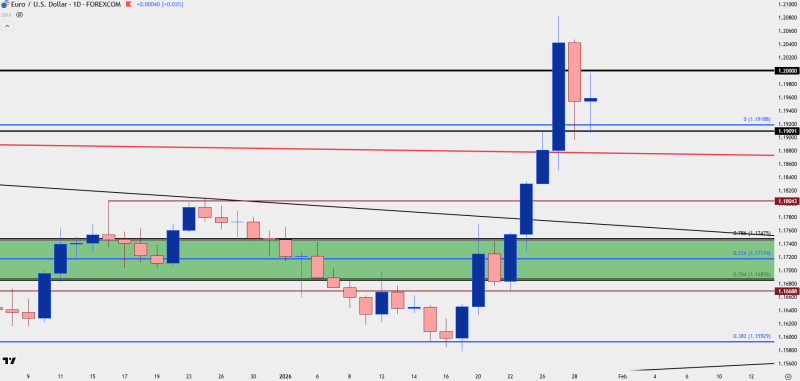

⬤ EUR/USD hit pause after its recent climb and formed a doji candle while testing the 1.1909–1.1919 support zone—a clear sign of hesitation rather than any definitive move. The price is hanging just above this critical area as traders assess whether the upward momentum can keep going. The daily chart shows the rally losing steam right before hitting the 1.2000 mark.

⬤ The chart reveals EUR/USD pulling back into a well-defined support band that's been playing double duty as both resistance and support lately. The price is still sitting above the broader demand zone, and that doji pattern points to an even match between buyers and sellers. This looks more like a breather after the recent push higher than any kind of trend reversal.

⬤ Looking at the upside, 1.2000 remains the big psychological hurdle. The chart shows how the pair has struggled to get comfortable above this level, confirming it as a resistance zone that won't be easy to crack. Changes in overall market sentiment could eventually help push through, but right now the price action is stuck between clearly marked technical boundaries.

⬤ This consolidation phase matters because it'll determine whether EUR/USD can hold its higher ground or slide into deeper ranging. Staying above 1.1909–1.1919 keeps the bullish setup intact, while continued failure at 1.2000 puts a lid on near-term gains. With indecision visible on the daily timeframe, the next few sessions will likely show whether the pair resumes climbing or stays trapped below resistance.