⬤ Silver had a solid run — steep rally, strong momentum, the whole picture looking bullish. But then it hit the top and flipped. XAG/USD printed a clear reversal structure right at elevated levels, and the move lower followed purely from what the technicals were showing, not from any shift in fundamentals.

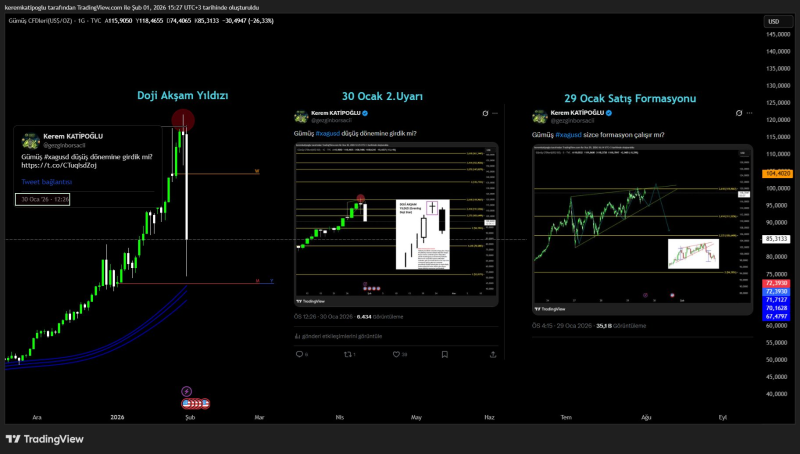

⬤ The key signal was a doji evening star near the peak. If you know your candlestick patterns, this one's a classic sign that upward momentum is running out of steam. It showed up right after a long stretch of bullish candles, and once it completed, silver couldn't hold those higher levels — price dropped quickly, and bullish control was gone.

⬤ After that first reversal signal, more sell confirmations followed fast. Silver broke below levels it had respected during the uptrend, and the speed of the drop tells you a lot — traders who jumped in late during the rally got caught offside when selling pressure hit, and that made the decline sharper.

⬤ Here's why it matters: silver tends to draw in speculative money during strong rallies, which means corrections can get ugly fast once sentiment shifts. With XAG/USD now pulling back from its highs, the real question is whether this settles into a normal consolidation or keeps sliding as the corrective phase deepens.