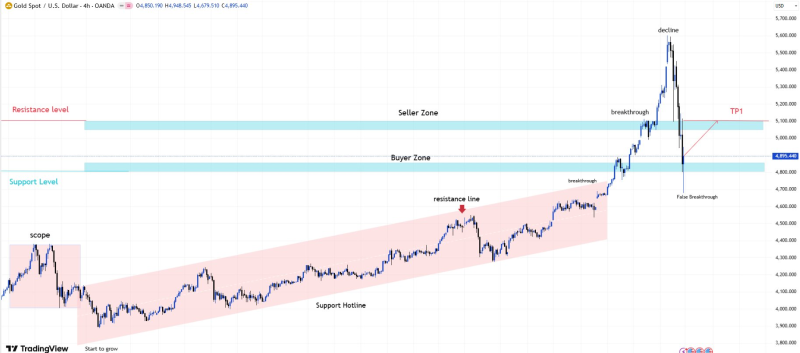

⬤ Gold has hit a major inflection point. On the 4-hour chart, XAU pulled back hard after a sharp rally and is now trying to find its footing above a clearly defined buying zone. What happens next in this area will pretty much decide whether the broader uptrend stays alive or starts to crack.

⬤ Here's the thing — gold actually broke above a rising resistance line earlier, which triggered a strong push into the upper seller zone. Price even squeezed a bit higher before reversing sharply, and that move is now being read as a false breakout. The selloff brought XAU/USD right back down into the buyer zone around mid-$4,800, where demand is trying to hold the line and absorb the selling pressure.

⬤ The buyer zone is the key level here. As long as gold stays above it, the chart points toward upside continuation rather than a full trend reversal. The next big target is $5,100 — that's the main resistance level, and if buyers regain momentum and push price back into the upper range, that's where things get interesting.

⬤ The bottom line: gold's reaction at this $4,800 zone will set the tone for near-term price action across precious metals. Hold here, and $5,100 stays in play. Fail here, and a deeper correction becomes the more likely path.