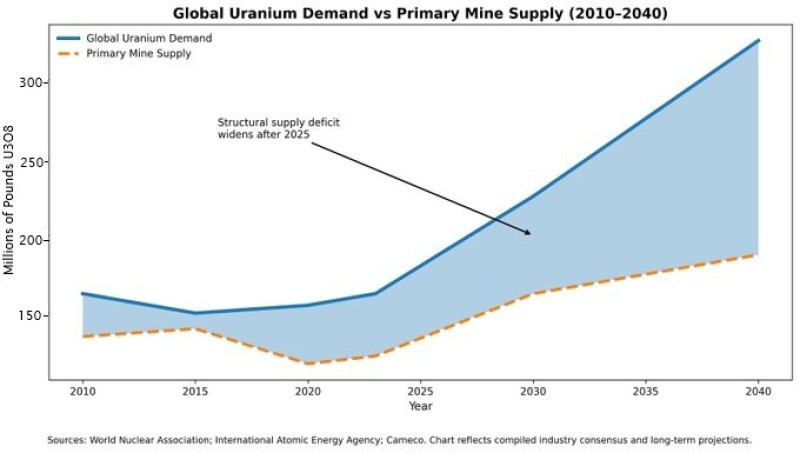

⬤ The uranium market is heading toward a serious supply crunch. New projections show demand will increasingly outstrip what mines can actually produce, with the gap widening sharply after 2025. This isn't a temporary blip—it's a structural problem driven by how slowly new uranium mines come online compared to how fast nuclear fuel needs are growing.

⬤ The numbers tell a clear story. Uranium demand is expected to climb from around 160 million pounds in the early 2020s to over 220 million pounds by 2030, then push toward 300 million pounds by 2040. Meanwhile, primary mine supply struggles to keep up, reaching only about 190 million pounds by the end of that period. The math doesn't work out.

⬤ Industry forecasts suggest nuclear fuel demand will jump roughly 28% by decade's end and could potentially double by 2040. New mines can't materialize overnight—they need years of development and significant capital investment. That timeline mismatch is creating a deficit that's only getting bigger.

⬤ This matters beyond just the uranium market. Nuclear power is becoming crucial for both energy security and climate goals. A persistent gap between what's needed and what mines can deliver will affect fuel availability, pricing, and how nuclear power plants secure their supply chains for years to come.