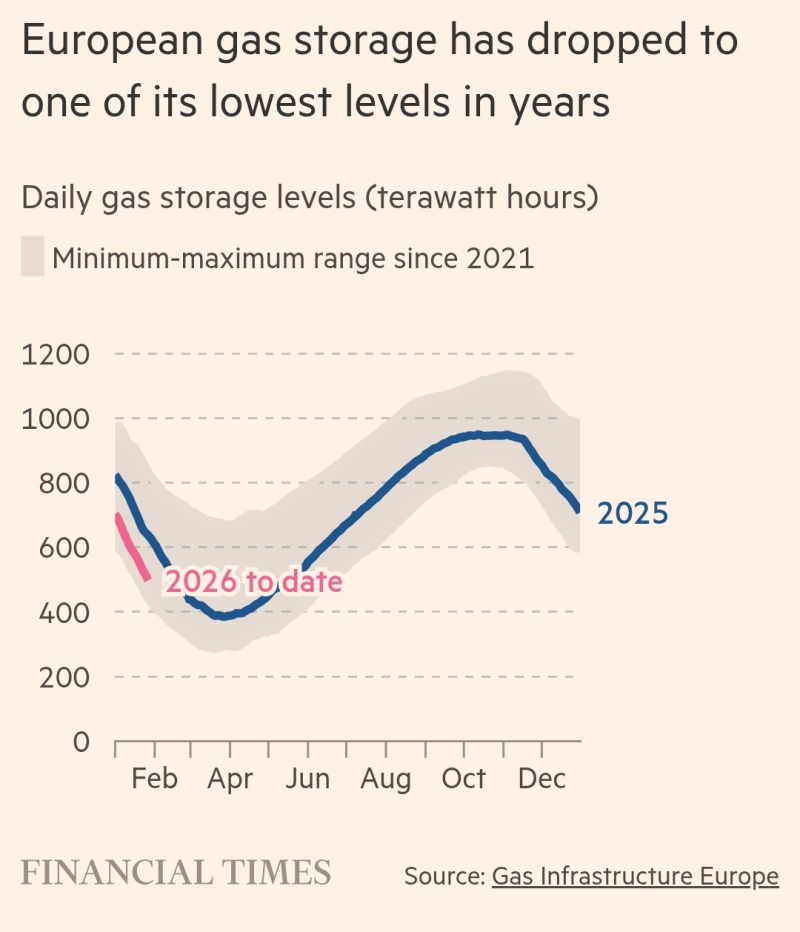

⬤ European natural gas storage levels have hit their lowest point for this time of year since before the 2022 energy crisis. The drop comes as Europe entered winter with below-average stockpiles, and colder-than-normal weather only made things worse — accelerating gas withdrawals across the region. Current storage levels are now tracking dangerously close to the lower bound of the range observed since 2021.

⬤ Data from Gas Infrastructure Europe tells a pretty clear story: inventories have fallen significantly faster than in any recent winter. Here's the thing — this season started with less margin to begin with. Unlike previous years that benefited from higher pre-winter buffers, Europe had no real cushion when the cold hit, and sustained heating demand did the rest.

⬤ Compare this winter to 2025, which followed a more balanced seasonal pattern with higher peaks and less severe drawdowns. This year? Storage levels declined earlier and more steeply, bringing inventories back to territory last seen before the 2022 energy crisis — despite Europe's diversification efforts and increased LNG imports.

⬤ So why should you care? Lower gas storage means less flexibility during peak winter demand and higher exposure to any supply or weather disruption. Tighter inventories will likely amplify price volatility and make refilling reserves ahead of next winter a tougher challenge. Bottom line: storage levels, weather, and supply security still drive Europe's energy market — and right now, the numbers aren't reassuring.

Vlad Demochko

Vlad Demochko

Vlad Demochko

Vlad Demochko