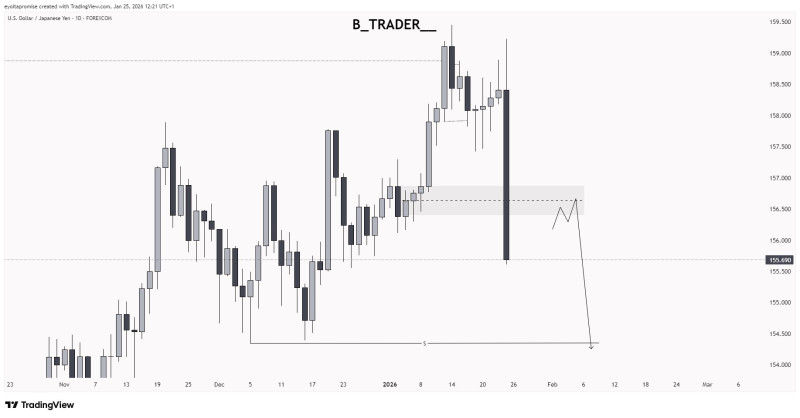

⬤ USD/JPY took a sharp turn lower after failing to hold gains near recent highs, signaling that sellers are taking control. The pair pulled back from the 158.50–159.00 zone and dropped toward the mid-155 area, with a strong bearish candle confirming the shift in momentum. The chart shows clear rejection at the top, suggesting buyers couldn't defend those levels.

⬤ Before the drop, the pair was consolidating and making several attempts to push higher, but none of them stuck. The gray area around 156.00 on the chart shows where price had paused before—what used to be support might now flip into resistance as selling picks up.

⬤ The bigger picture points to more risk on the downside. The projected path hints at a short-term bounce followed by another leg lower, potentially taking the pair toward 154.00. After peaking recently, momentum has clearly faded, and lower highs are starting to form—classic signs that the rally is running out of steam.

⬤ USD/JPY tends to move with shifts in market positioning and short-term sentiment, so this price action matters. If the decline continues from here, it confirms the corrective phase is underway. With the pair now sitting well below recent highs, the next few sessions will show whether it stabilizes or keeps sliding toward deeper support levels.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur