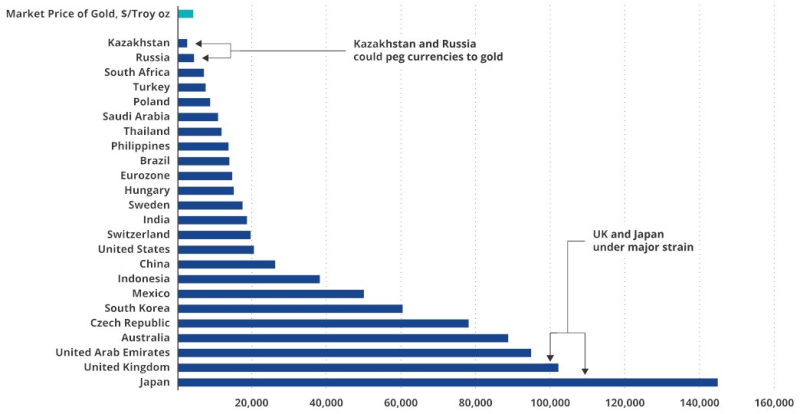

⬤ A fresh comparison showing gold price levels needed to fully back national money supplies is exposing massive gaps between resource-rich nations and debt-heavy economies. Russia and Kazakhstan are the only countries that could back their entire monetary base with gold at today's prices. Everyone else would need gold to trade significantly higher, showing just how far fiat money printing has gone beyond actual reserve backing.

⬤ The numbers tell a stark story. Europe would need gold around $17,000 per ounce to fully cover its monetary base, while the US would require roughly $20,000. But Japan sits in a category of its own at approximately $142,000 per ounce. Both Japan and the UK show the most pressure, revealing how thin gold coverage has become in economies built on aggressive monetary expansion.

The wide range of implied gold prices underscores why gold continues to play a strategic role in discussions around currency stability and monetary resilience.

⬤ Other major economies land somewhere in between. China, Indonesia, Mexico, South Korea, and Australia would all need gold prices well above current levels but nowhere near Japan's extreme benchmark. These gaps reflect decades of different policy choices around debt, money printing, and reserve management. Russia and Kazakhstan look relatively solid thanks to holding more gold compared to the size of their money supplies.

⬤ This comparison matters because it shows the growing disconnect between paper money and real assets backing it. While nobody expects immediate policy changes, the data explains why gold keeps coming up in conversations about currency confidence and what happens when monetary systems face serious stress.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko