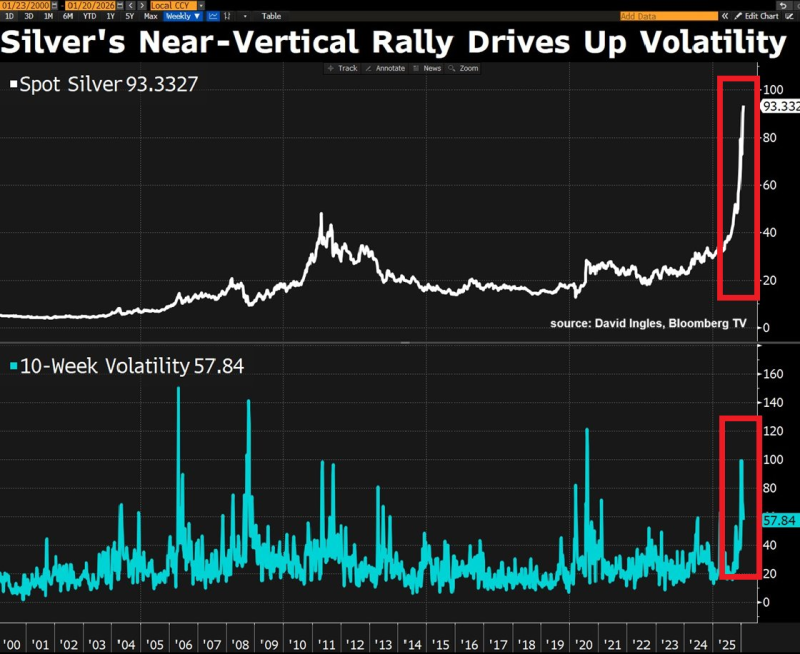

⬤ Silver has gone nearly vertical, blasting into the mid-$90s per ounce in what's shaping up as one of the most dramatic rallies in decades. The move has sent volatility through the roof, with readings that haven't been seen since some of the century's most turbulent market periods. Spot silver is currently changing hands around $93, following a breakout that's left years of sideways trading in the dust.

⬤ Since November, silver has more than doubled—crushing performance across nearly every other major asset class. Asian markets have been paying a premium, showing this isn't just a regional phenomenon but a global scramble for the metal. The speed of this rally looks eerily similar to past historical spikes where prices took off in compressed bursts rather than steady climbs.

⬤ The volatility numbers tell the story. The 10-week measure briefly kissed 100—one of the highest readings in the past century. While it's backed off to the high-50s, history shows these kinds of spikes don't happen in isolation. Past episodes at similar levels typically preceded either sharp pullbacks or lengthy consolidation periods where silver struggled to hold gains.

This development matters because volatility at these levels can significantly alter market behavior.

⬤ When volatility hits these extremes, everything changes. Short-term swings get amplified, risk sensitivity shoots up, and trader conviction gets tested hard. Whether silver can hold these levels or faces a nasty correction will set the tone across precious metals markets—and determine if this is a genuine repricing or just a late-stage blowoff top.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur