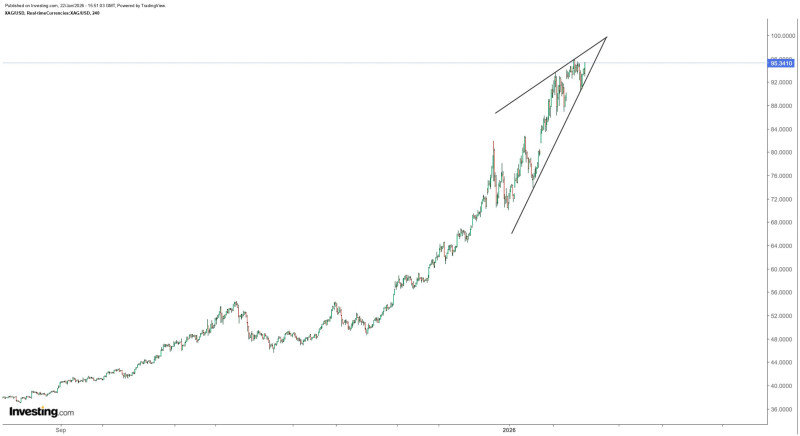

⬤ Silver has extended its long-term rally, with XAG/USD trading just below the $95 area as price action compresses into an ascending wedge formation. The current setup shows a steady advance from below $40 into the mid-$90s, followed by a tightening structure near recent highs that's being watched closely as silver approaches a potential breakout point.

⬤ The chart reveals a clear pattern of higher highs and higher lows, reflecting sustained upward momentum over several months. Recent trading shows silver bouncing within converging trendlines, with reduced volatility as the metal approaches the apex of the wedge. XAG/USD holding near $95 puts price within striking distance of the psychologically significant $100 level—a major round-number target visible just above current levels.

⬤ Despite periodic pullbacks during the rally, silver continues to attract buying interest, with declines staying relatively shallow. The ascending wedge structure captures this balance between ongoing demand and cooling upside momentum. As price narrows within the pattern, traders are positioning for a bigger directional move once silver breaks beyond the wedge boundaries, with price remaining firmly near the upper region of the formation.

⬤ This consolidation phase matters because silver straddles both investment and industrial demand. XAG/USD trading near long-term highs amplifies sensitivity to shifts in market sentiment, liquidity conditions, and macro expectations. With price coiling just below key psychological territory, how silver reacts around the wedge boundary could influence near-term volatility and shape momentum across the broader precious metals market in coming sessions.