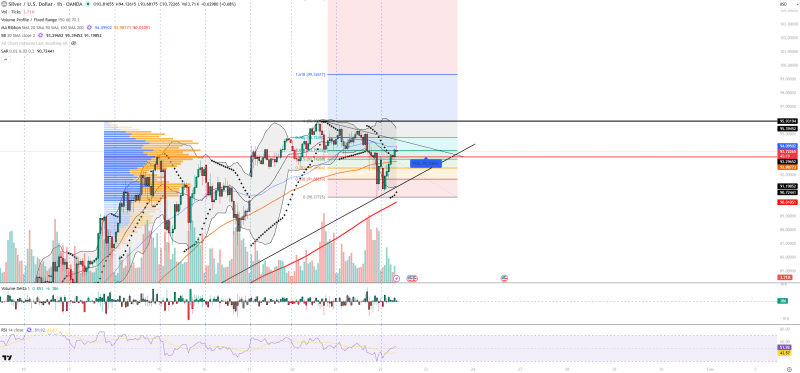

⬤ Silver prices are trying to find their footing on the hourly chart after pulling back from recent highs. XAG/USD corrected from higher levels and is now attempting to recover while staying above an ascending trendline. Recent candles show buyers stepping in at the lower area to defend support, though sellers are still pushing back near the upper range, keeping things contained for now.

⬤ Right now, silver is trading around the $93.70 area, close to the equilibrium zone. The Relative Strength Index sits near 52, showing neutral momentum with space to move either way. Volume is moderate, suggesting the recent buying activity is more reactive than aggressive. The Volume Profile identifies $93.30 as the point of control, confirming this level as a key balance area where supply and demand are currently meeting. Volume delta readings remain positive, showing buyers are slightly more active than sellers despite the lack of a clear breakout.

⬤ Other technical indicators support a short-term consolidation picture. Bollinger Bands show price rotating back toward the middle band, signaling things are normalizing after recent volatility. The Parabolic SAR remains below price, acting as short-term support and showing that downside pressure has eased. Support levels are clearly marked at $93.00, $92.70, $91.90, and $90.70, while resistance stands at $94.00, $94.60, $95.40, and $96.30. As long as silver stays above the rising trendline, the medium-term bullish structure holds, even though near-term direction remains uncertain.

⬤ This setup matters for the broader market because silver often reflects both safe-haven dynamics and industrial demand expectations. The strong underlying trend in gold continues to provide support for silver prices, while medium-term industrial demand prospects remain constructive. At the same time, silver's naturally volatile nature means sharp short-term swings are still possible. How price behaves around the $93.30 balance zone and nearby resistance levels will likely determine whether silver resumes its upward move or extends its consolidation phase.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur