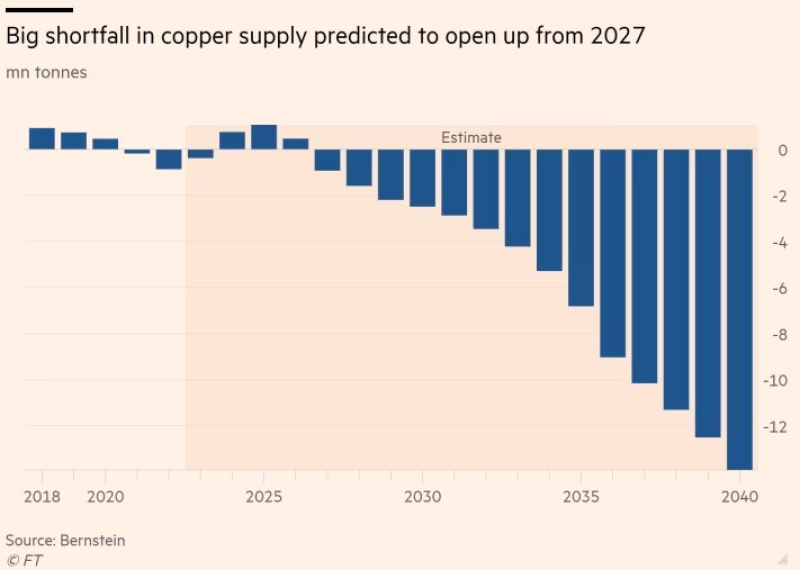

⬤ The global copper market is heading toward a major structural imbalance. Projections show supply deficits emerging from 2027 and deepening through at least 2040. What starts as a relatively modest shortfall quickly transforms into a persistent undersupply that could reshape the entire commodities landscape.

⬤ The numbers tell a stark story. Annual deficits are expected to widen throughout the 2030s, reaching over 10 million tonnes by 2037—roughly half of today's total global mine output. Early-year shortfalls look manageable, but the trajectory accelerates sharply as demand growth consistently outpaces new supply coming online.

⬤ The cumulative deficit over this period could hit approximately 80 million tonnes. To put that in perspective, that's more than three years' worth of current worldwide mine production. The gap isn't a temporary blip—it's a fundamental mismatch between how fast demand is climbing and how quickly the industry can scale up extraction and refining capacity.

⬤ This matters far beyond copper markets. The metal sits at the heart of industrial production, electrification infrastructure, and renewable energy buildouts. A widening, multi-year supply crunch could fundamentally alter pricing dynamics, push miners to accelerate exploration spending, and force end-users to rethink supply chain strategies well before the tightest years hit.

Tatiana Dementieva

Tatiana Dementieva

Tatiana Dementieva

Tatiana Dementieva