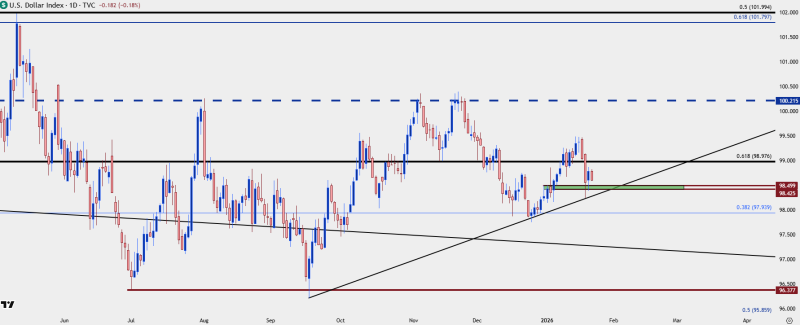

⬤ The U.S. Dollar Index weakened modestly in the latest session, posting an inside-day candle after holding a rising trendline support. The daily chart shows price consolidating below the 100.20 resistance zone with no clear breakdown, suggesting short-term hesitation rather than a confirmed reversal.

⬤ The prior session saw a successful defense of support, while the following day stayed range-bound inside the previous candle. This kind of price action typically signals consolidation after directional movement. Despite the recent softness, the dollar remains above late-2025 lows, showing that downside momentum hasn't picked up steam.

⬤ Meanwhile, euro price action has become the main short-term driver. EUR/USD bounced sharply from the 1.1600–1.1620 support zone, reclaiming higher ground after a strong bullish push. The four-hour chart shows a series of higher lows following the rebound, confirming that euro strength is weighing on the dollar due to its heavy presence in the DXY basket.

⬤ Focus now shifts to the upcoming Bank of Japan policy decision. The yen makes up roughly 13.6% of the dollar index, meaning any volatility in yen pairs could meaningfully impact overall dollar performance. While the dollar has softened early on, key support levels are still holding.

The charts indicate that key support remains intact, leaving direction dependent on central bank signals and continued euro momentum.

⬤ The current setup reflects a transitional phase for the dollar—driven more by consolidation and relative currency strength than any decisive trend. With technical support intact and major policy events on the horizon, markets are watching closely to see whether the dollar stabilizes or extends its pullback as global monetary conditions shift.

Alex Borzak

Alex Borzak

Alex Borzak

Alex Borzak