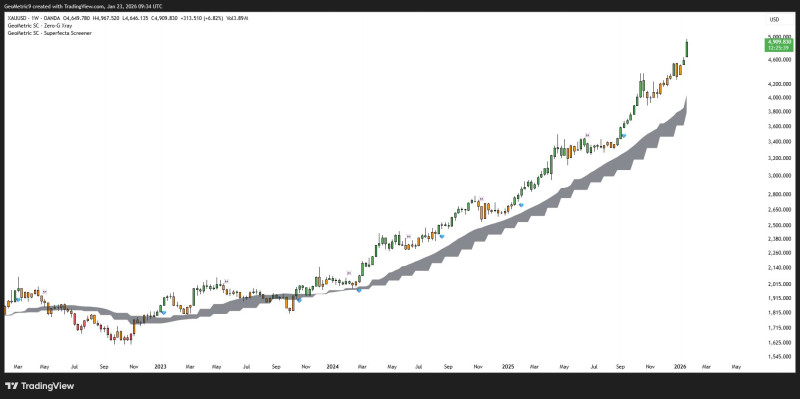

⬤ Gold has been on a tear since late 2022, with XAU/USD now pushing into the $4,900 zone on weekly charts. This price level sits at the top of a multi-year rising channel where several major technical indicators converge. While no one's calling a definitive top yet, traders are watching closely to see if gold finally takes a breather at these historically important levels.

⬤ The chart paints a clear picture: steady buying pressure, higher highs, and a rock-solid support base that's held firm throughout the rally. Gold's been riding comfortably above its long-term support band, showing that buyers are still very much in control. But with prices stretched this far, anyone jumping in now is paying premium prices, which naturally raises questions about how much runway is left.

⬤ "Confirmation is essential before drawing conclusions about any potential shift in trend," the analysis notes. "We're watching for specific technical signals and changes in bar behavior near these macro levels."

⬤ What happens next matters beyond just gold traders. The metal often reflects broader economic anxieties and institutional money flows, so any real reversal here could ripple across multiple asset classes. For now though, the uptrend technically remains intact until proven otherwise. The key is watching how price actually behaves at these levels rather than trying to predict what it should do.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko