⬤ Gold has stepped back from its recent peak after geopolitical tensions cooled a bit, but the upward momentum is still very much alive. The pullback happened when former President Trump hinted at a softer approach on Greenland, which took some heat off the market. Still, there's enough uncertainty floating around to keep investors interested in gold as a safe haven, even with the slight correction we're seeing now.

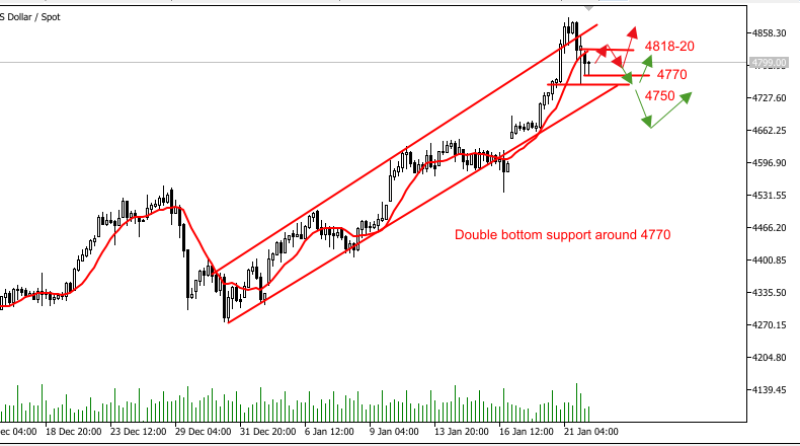

⬤ XAU/USD hit an all-time high near $4,888 before running into sellers. Prices dipped below $4,800 briefly, touching around $4,756 at the low point. The good news? It didn't break the $4,750 floor, which has been a solid psychological and technical foundation. The chart shows gold is still moving within a rising channel, meaning the overall bullish picture hasn't changed despite some short-term choppiness."

⬤ Right now, traders are watching the $4,770 zone closely. That's where a double-bottom support pattern is forming, and so far it's been holding up well against downside pressure. On the flip side, resistance sits around $4,818 to $4,820—that's where recent rallies have hit a wall. If gold can push back above $4,800 and hold it, we could see another run at $4,900. Break through that level convincingly, and the psychological $5,000 mark starts looking realistic based on the current trend.

⬤ This consolidation phase tells us something important: the market is balancing easing tensions against ongoing uncertainty. The fact that gold is holding firm above key support after making record highs shows there's real strength underneath, even as prices move sideways for now. How gold behaves around that $4,770 support and $4,820 resistance will likely decide whether we're gearing up for another leg higher or heading into a deeper pullback.

Alex Bobrov

Alex Bobrov

Alex Bobrov

Alex Bobrov