⬤ XAG Silver Futures climbed after bouncing from a key support zone during Wednesday's dip, sparking fresh buying momentum. The bounce from that level cleared the path for another leg up, with prices now hitting new highs. Silver is currently trading around 103.00, confirming the uptrend remains alive after the recent pause.

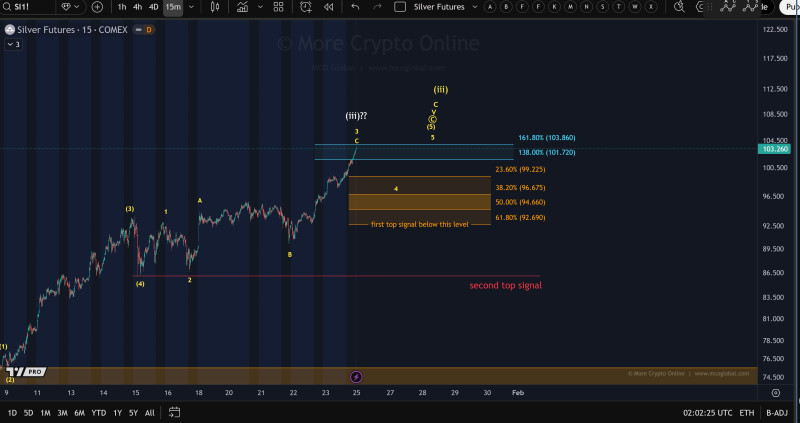

⬤ The chart reveals a clear Elliott Wave pattern, with price moving through what looks like a late-stage fifth-wave rally. Fibonacci targets sit near 101.72 and 103.86, both lining up with current price action. Below the market, support levels around 99.22, 96.67, and 94.66 are marked as important structural floors. Silver's ability to hold above these zones has kept the bullish trend going strong.

⬤ Even though the wave structure appears nearly complete, there's still no technical proof of a market top. Key support areas are holding firm, and momentum hasn't shown clear exhaustion signs. The orange support zone on the chart is especially critical—if price breaks below it, that would signal a potential trend shift. Until that happens, more upside is technically on the table.

⬤ This setup matters for the precious metals market because it shows silver's strength even at elevated prices. With support intact and no confirmed reversal, silver futures are set for continued action—either through additional gains or sideways movement rather than an immediate drop. How price behaves around those support zones in the next few sessions will determine whether this rally transitions into a pullback or keeps pushing higher.

Alex Bobrov

Alex Bobrov

Alex Bobrov

Alex Bobrov