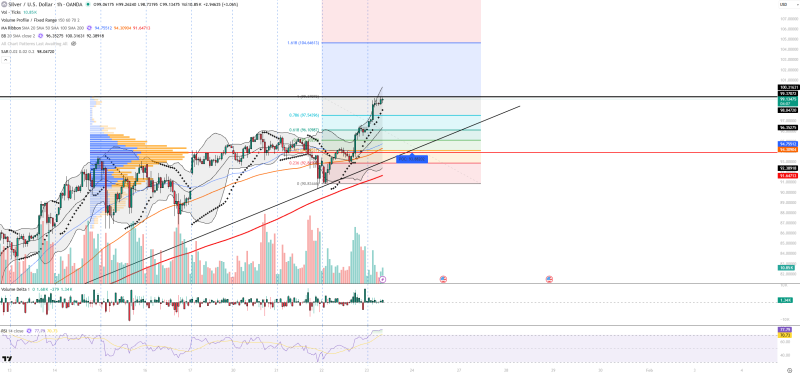

⬤ Silver just pushed through a massive rally and is now chilling in the $99-100 range on the XAG/USD 1-hour chart. The price shot up past key resistance levels during a strong impulse move, and now it's consolidating near the top of its current channel. What's important here is that silver's staying inside an ascending channel pattern—meaning the bigger uptrend is still intact even though momentum's cooling off for now.

⬤ Looking at the technicals, XAG/USD is trading comfortably above its short-term moving averages, and what used to be resistance has flipped into support. The Volume Profile shows a Point of Control sitting at $93.88, which puts current prices way above the main trading zone—that's a solid sign of trend strength. The candlestick action shows orderly consolidation without any reversal patterns popping up, which keeps bulls in control.

⬤ Momentum's still running hot. The RSI is hovering around 77, which technically puts it in overbought territory, but there's no bearish divergence showing up yet. Volume spiked during the rally, proving buyers are actively engaged, and the volume delta stays positive—more buying pressure than selling. Bollinger Bands have price hugging the upper band, classic strong-trend behavior, and the Parabolic SAR remains below price, confirming upside momentum's still alive.

⬤ This consolidation matters for the precious metals market overall. Silver's strength lines up with a weaker US dollar and steady demand for metals that work both as money and industrial materials. The fact that XAG/USD is holding firm near recent highs shows the trend's got resilience—the market's digesting gains rather than reversing. This setup keeps silver moving in sync with gold and reflects solid sentiment across precious metals.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur