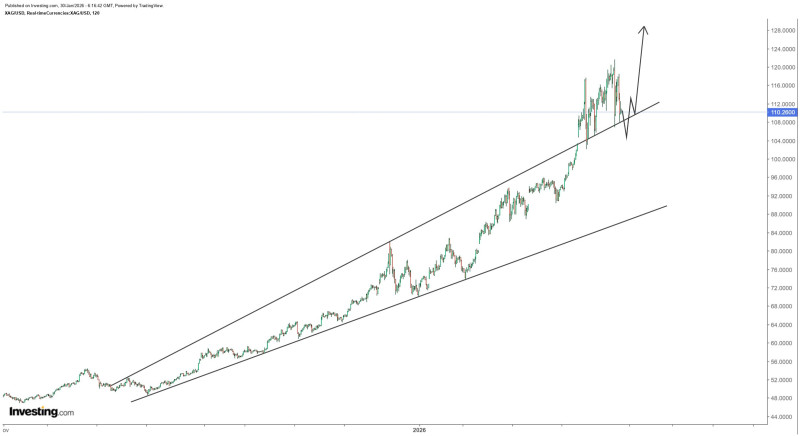

⬤ Silver is holding firmly within a long-term rising channel on the XAG/USD chart, showing consistent bullish momentum. The metal has climbed from under $50 to above $110 while maintaining respect for both rising support and resistance boundaries. Market analysis suggests a short-term pullback toward $105 remains on the table before silver gears up for its next leg higher.

⬤ Recent price action shows XAG/USD silver touching the upper edge of its ascending channel, where it's now catching its breath after an extended run. The $105 level lines up neatly with the rising trendline support visible on the chart, making it a logical target if we see a near-term correction.

⬤ The bigger picture for XAG/USD silver stays bullish despite pullback risks. The chart clearly shows higher highs and higher lows stacking up, keeping the upward momentum alive. A controlled drop to $105 would actually fit perfectly within the channel structure and wouldn't damage the broader bullish outlook, including the potential push toward $150 down the road.

⬤ Silver's performance matters beyond just precious metals traders. As a key sentiment gauge for the entire metals sector, XAG/USD strength often ripples through related assets. How well silver defends its rising support line could be crucial for keeping the current trend intact and market confidence strong.

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia

Tatiana Kashyrskaia