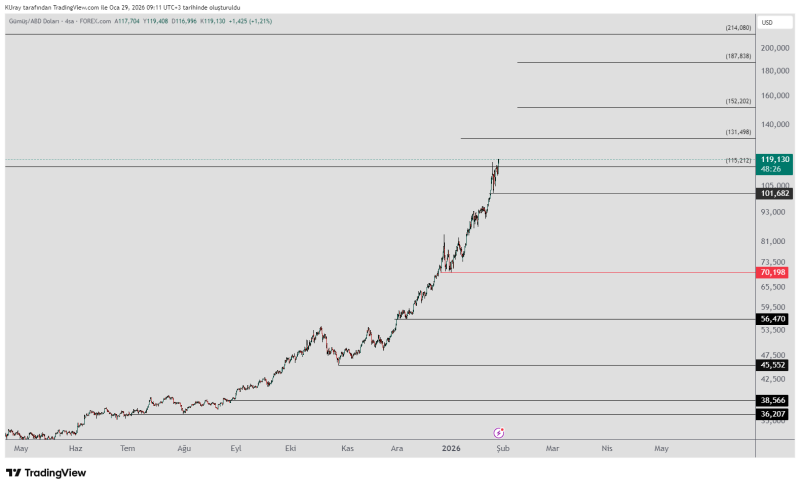

⬤ XAG Silver is holding its ground above the critical $115 mark, staying locked in a solid upward pattern. After pushing through this barrier, the metal has settled into a consolidation phase right above what used to be resistance—now turned support. The daily chart shows price action respecting this new floor while the broader bullish trend stays intact.

⬤ With $115 now acting as a safety net, traders are eyeing the next resistance levels at $131, $152, and $187. These zones match up with previously spotted ceiling areas. The $101 level marks an important middle ground—as long as silver stays above this point, the uptrend looks solid. Right now, there's nothing in the price structure suggesting a reversal.

⬤ On the flip side, the $70.198 level represents major long-term support, though it's sitting well below current prices. This level acts as the ultimate line in the sand for the bigger trend. If silver manages to avoid daily closes under this mark, the dominant upward move stays valid. Any dips from here look more like healthy pullbacks rather than trend changes.

⬤ This setup matters because silver is testing multiple resistance levels after a strong rally. Holding above former resistance keeps the bullish structure alive, while clearly marked support zones help define where things could get dicey. With silver maintaining strength above $115, the chart points toward those higher resistance targets—assuming the key support levels hold and the overall trend structure doesn't crack.

Alex Borzak

Alex Borzak

Alex Borzak

Alex Borzak