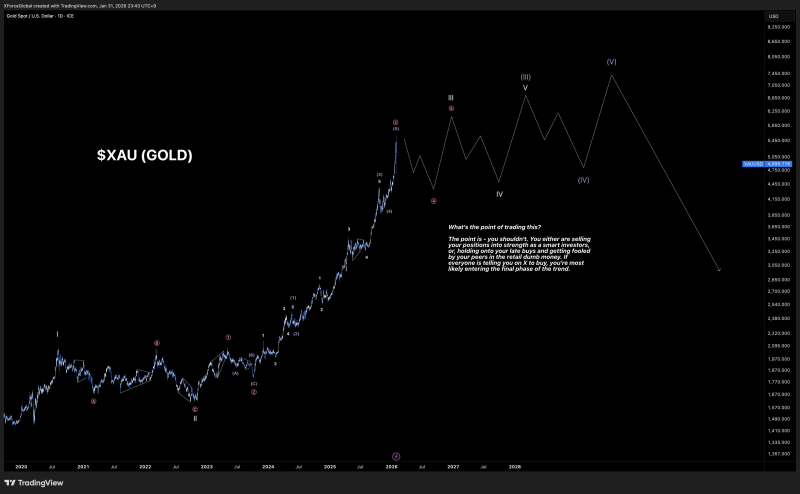

⬤ Gold has shifted into wild price swings after years of steady climbing took XAU/USD to elevated territory through late 2025 and early 2026. What followed was anything but calm—sharp drops quickly reversed 20-30% of the final rally leg, turning what looked like momentum into sudden uncertainty. The steady upward grind has given way to jagged, unpredictable moves.

⬤ The chart reveals how gold surged into extended wave patterns before snapping back toward earlier resistance-turned-support zones. After pushing higher with conviction, the market reversed hard, erasing substantial gains in compressed timeframes. This whipsaw action is classic late-stage behavior—buyers pile in near the top, then scramble when momentum stalls and selling pressure floods back in.

⬤ Instead of clean trends, the price structure now shows overlapping rallies and deeper pullbacks. The projected path suggests a messy topping process rather than smooth continuation. Sharp bounces get met with equally aggressive selloffs, creating a minefield for timing entries and exits as the trend loses its earlier consistency.

⬤ This matters beyond gold itself. XAU/USD often mirrors broader cycle shifts and sentiment changes across markets. When price action turns erratic after a long run higher, it usually signals conditions are shifting and risk is climbing. The current volatility underscores how late-cycle environments can amplify swings and punish complacency, making discipline essential as trends age and stability fades.

Ivan Zhigalov

Ivan Zhigalov

Ivan Zhigalov

Ivan Zhigalov