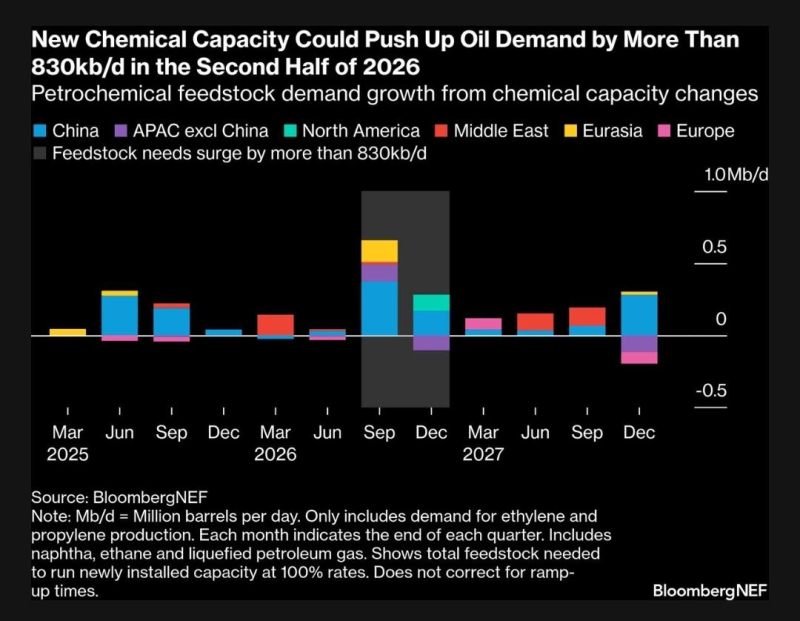

⬤ Oil demand tied to petrochemicals is about to get a serious boost in late 2026. New chemical facilities going live worldwide could push feedstock consumption up by more than 830 kb/d in the second half of next year. BloombergNEF data shows this isn't just seasonal noise—it's real structural growth from fresh capacity hitting the market.

⬤ The spike shows up clearest in 2H 2026, when all that new capacity stacks up and total feedstock needs take a sharp jump. China and North America are driving most of the increase, but the Middle East and other regions are adding to it too, pushing the total well past 830 kb/d.

⬤ These numbers assume all the new ethylene and propylene plants run at full tilt right away. The calculations cover naphtha, ethane, and LPG demand, measured in million barrels per day. Real-world demand might ramp up more slowly though, depending on how fast operators can actually get these plants running at peak rates.

⬤ This matters because petrochemicals are becoming a bigger piece of the oil demand puzzle. An 830 kb/d bump from new capacity alone could shift regional supply-demand math and change how traders think about consumption growth heading into late 2026 and beyond.