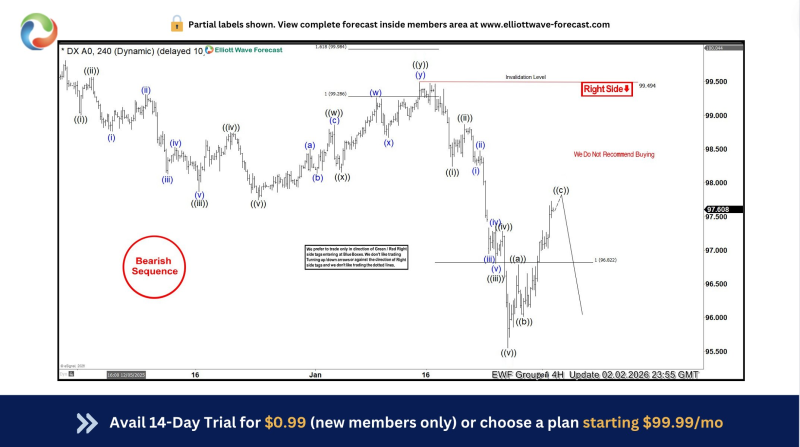

⬤ DXY got slapped down after trying to push past the 99.50 resistance zone. The equal-legs area marked the top of a corrective move, and once the index hit that ceiling, sellers jumped in fast. Price broke through support levels and confirmed a bearish sequence is now underway.

⬤ The current setup shows DXY trading below its invalidation level—meaning buyers should stay on the sidelines for now. Elliott Wave structure suggests this isn't just a quick dip but part of a bigger downward phase, with the index potentially heading toward the 96-97 range.

⬤ This matters because when the dollar weakens, it shifts the entire landscape—currencies, commodities, and risk assets all start dancing to a different tune. The rejection from technical extremes adds weight to the bearish case, and if DXY keeps sliding, expect ripple effects across global markets as traders watch whether this breakdown extends or finds a floor.

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko

Dmitri Lysenko