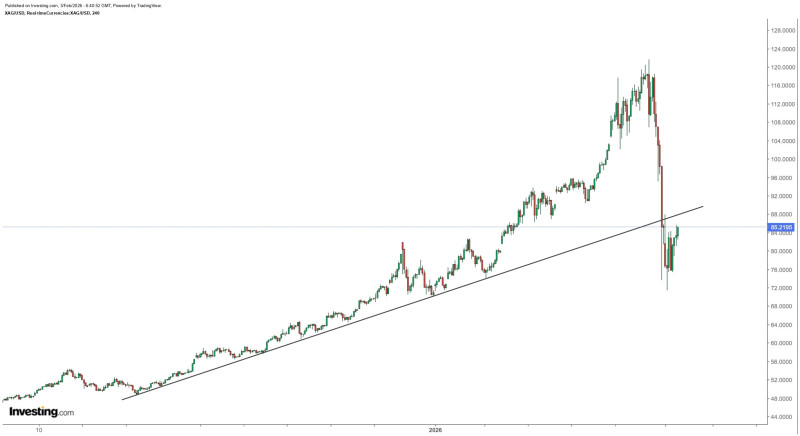

⬤ Silver just went through an absolute bloodbath over the past three sessions, shedding roughly 41% of its value in what can only be described as a brutal selloff. The carnage has pushed the metal down to a critical technical zone around $88, which lines up perfectly with a rising trendline that got completely smashed during the decline. The chart tells the whole story — what used to be solid support is now looking like a wall silver needs to break through.

⬤ Before everything went south, silver was riding a clean uptrend, supported by a rising trendline that held for months. Then the floor fell out. Prices crashed right through that structure in a decisive breakdown that left no room for interpretation. Since bottoming out, silver's tried to mount a comeback, but that former support near $88 has flipped into potential resistance — exactly what you'd expect after a trendline gets violated this hard.

⬤ The chart shows silver's attempting a bounce, but it's still trading below that broken trendline, which leaves the whole setup looking shaky. If it can reclaim $88, that'd signal the worst of the selling is probably over and the market's finding its footing. But if it fails to push back above this level, then this wasn't just a quick correction — it's a sign something bigger shifted, and the downside risk stays very real.

⬤ This moment matters beyond just silver. The metal typically reflects both industrial demand and broader risk appetite, so what happens at this $88 trendline will tell us whether this was a one-time shock or the start of a deeper unwind. With volatility still running hot, how silver handles this technical test is going to set the tone for momentum across the entire precious metals space.

Helena Izotova

Helena Izotova

Helena Izotova

Helena Izotova