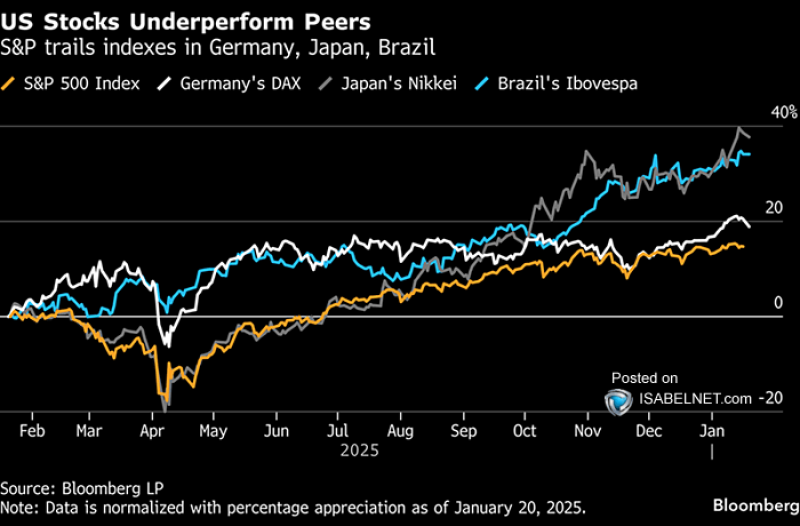

⬤ The S&P 500 has been trailing major international equity markets for most of the past 12 months, marking an unusual stretch of underperformance for U.S. stocks. American equities have fallen behind benchmarks in Germany, Japan, and Brazil, signaling a notable shift in global market leadership. Data normalized as of January 20, 2025, shows the S&P 500 lagging several overseas indexes despite posting positive gains overall.

⬤ Germany's DAX, Japan's Nikkei, and Brazil's Ibovespa have all delivered stronger percentage returns than the S&P 500 during this period. While U.S. stocks continued climbing, they've moved at a slower pace compared to international peers. Foreign markets pushed toward the top of the performance range, while the S&P 500 stayed closer to the bottom, highlighting the scale of this divergence.

⬤ A weaker U.S. dollar throughout much of this period has amplified returns for international assets when converted back to dollars, making emerging and foreign markets more attractive. Meanwhile, U.S. equities missed out on this currency boost. This dynamic has helped sustain the outperformance abroad, even as global risk appetite remained relatively healthy.

⬤ This shift matters because it shows how currency trends can reshape relative equity returns across different regions. If the U.S. dollar stabilizes or strengthens again, the advantage international markets currently enjoy could disappear. For now, the gap between U.S. stocks and global peers remains a key indicator for market positioning and cross-border investment flows.

Nataly Kambur

Nataly Kambur

Nataly Kambur

Nataly Kambur