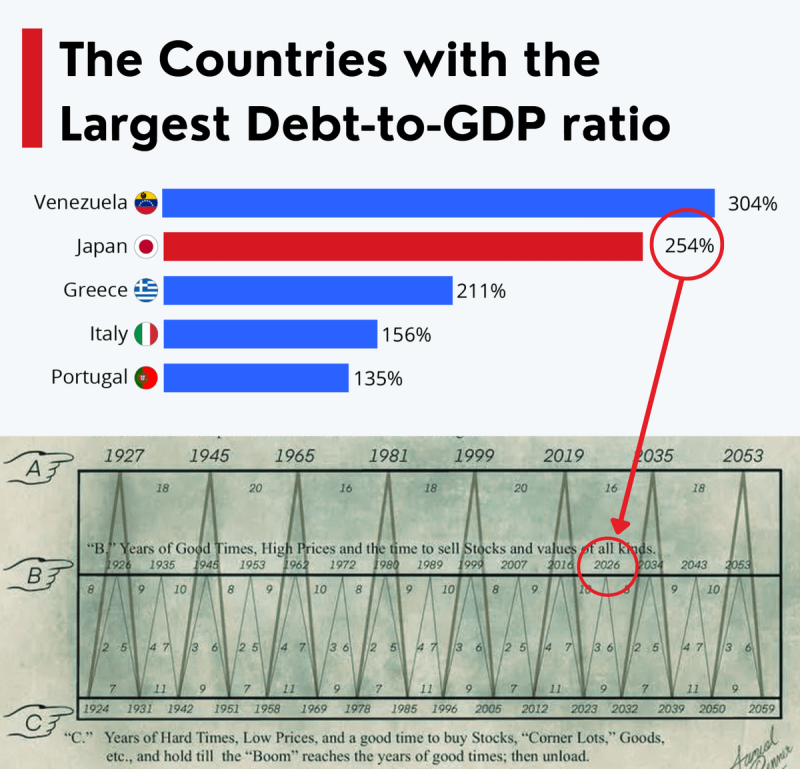

⬤ Japan's debt situation is back under the spotlight as its debt-to-GDP ratio hovers near 254 percent—the second-highest globally after Venezuela. But unlike other heavily indebted nations, Japan plays a unique role as a critical funding source for international capital markets, making its fiscal health a matter of global concern rather than just a domestic issue.

⬤ For years, Japan's rock-bottom interest rates turned the yen into the world's go-to funding currency. Investors borrowed yen cheaply and poured that money into higher-yielding opportunities—U.S. stocks and bonds, emerging markets, crypto assets, you name it. But something's changing. The usual relationship between USD/JPY and yield spreads has flipped dramatically. The yen is weakening even as Japanese yields climb, suggesting markets are pricing in serious fiscal and funding risks that weren't there before.

⬤ The numbers tell the story. Japan just approved a record 122.3 trillion yen budget for fiscal 2026, with debt servicing costs jumping roughly 10.8 percent to about 31.3 trillion yen. Here's the kicker: foreign investors now account for around 65 percent of monthly Japanese Government Bond trading. That means Japan's bond market stability depends more on international money flows than on domestic buyers—a fundamental shift that makes the whole system more vulnerable to global sentiment swings.

⬤ Why should anyone outside Japan care? Because Japan holds nearly $12 trillion in overseas assets. If the country needs to bring that money home, it means selling U.S. bonds, global equities, and other foreign holdings—potentially triggering liquidity shocks across multiple markets including digital assets. The combination of crushing public debt, rising yields, and heavy reliance on foreign bond buyers explains why traders worldwide are watching Japan's financial conditions so closely. This isn't just a local problem—it's a potential trigger for broader global liquidity stress.

Ivan Zhigalov

Ivan Zhigalov

Ivan Zhigalov

Ivan Zhigalov